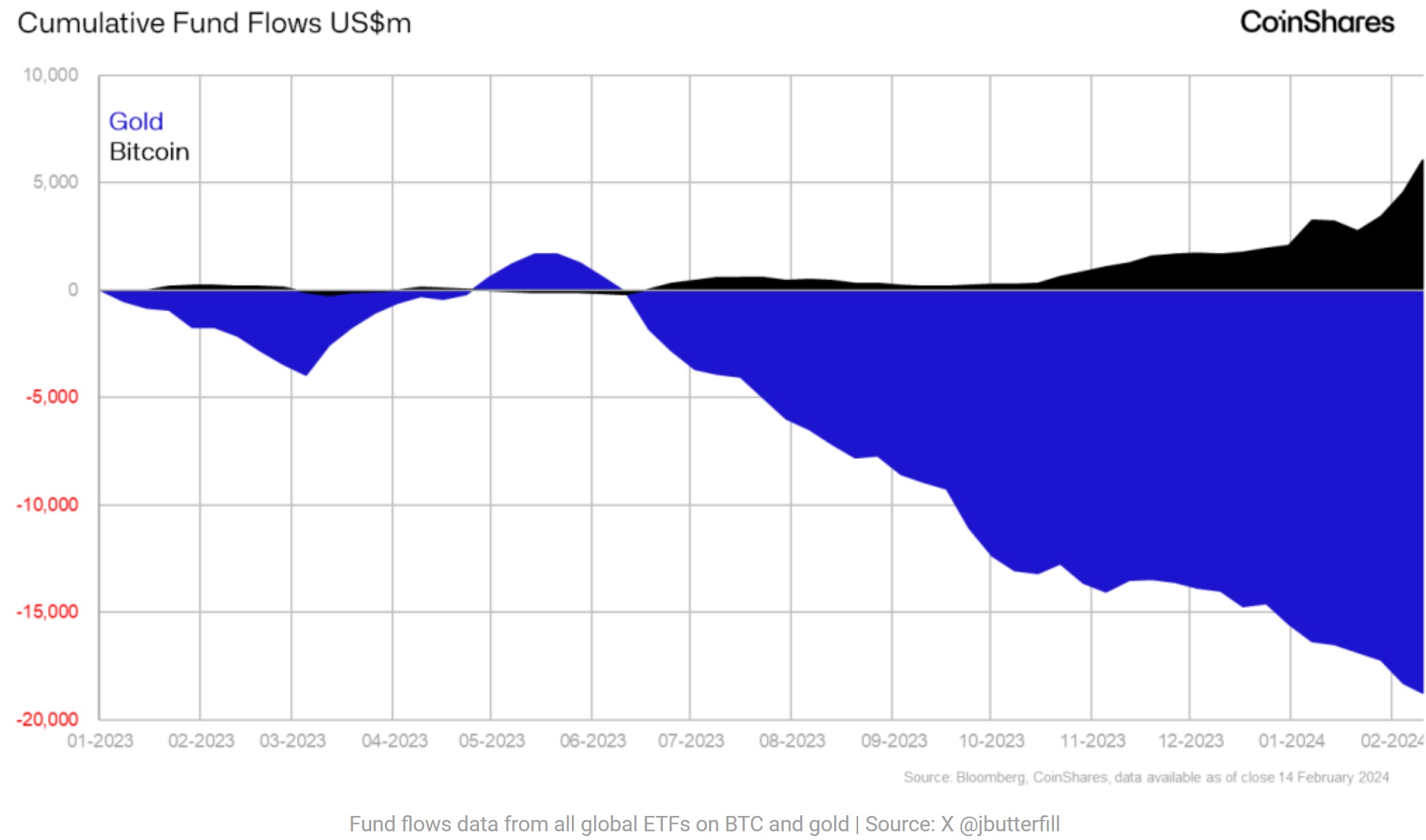

In recent times, the investment landscape has undergone a notable transformation, marked by a surge in Exchange-Traded Funds (ETFs) dedicated to Bitcoin, while witnessing substantial outflows from gold ETFs. This trend reflects a burgeoning interest among investors in digital assets as opposed to traditional safe-haven options, signaling a significant evolution in investment strategies.

Transition from Gold to Bitcoin

Data from Farside reveals a substantial influx of $4.115 billion into Bitcoin ETFs since the approval of 10 spot Bitcoin ETFs on January 11. This surge has been accompanied by record-breaking trading volumes, with notable instances of over 12,000 BTC net inflows across all ETFs, including a significant 10,000 BTC inflow into BlackRock alone. Impressively, spot Bitcoin ETFs have seen three consecutive days with over 10,000 BTC net inflows.

In stark contrast, leading gold ETFs have experienced considerable outflows totaling $2.4 billion in 2024. Analysts, such as Eric Balchunas from Bloomberg Intelligence, highlight significant outflows from BlackRock’s iShares Gold Trust Micro and iShares Gold Trust, amounting to $230.4 million and $423.6 million, respectively.

Insights into the Shift

James Butterfill, Head of Research at CoinShares, provides insight into this shifting dynamic, suggesting that despite positive price action, gold ETP flows have been dwindling, with some of these outflows finding their way into Bitcoin ETPs. This observation underscores a clear correlation between the decline in gold investments and the rising appeal of BTC among ETF investors.

Portfolio manager Bitcoin Munger emphasizes the magnitude of this asset transfer, stating that not only is Bitcoin attracting funds, but gold is experiencing significant outflows across many ETFs. This shift has prompted Munger to predict a rapid decline in gold’s dominance in favor of Bitcoin.

Performance Analysis

BTC has demonstrated remarkable performance, with a 22% increase since the beginning of the year, reaching a two-year high of $52,519 (on Binance) at present. Conversely, gold has seen a 3.3% decrease during the same period, hitting a two-month low of $1,988 per ounce. However, Eric Balchunas suggests that the movement away from gold ETFs might not solely be towards Bitcoin but could also be driven by a fear of missing out on US equities.

Changing Perceptions

The evolving investment landscape has sparked a debate between traditional and digital asset investors. Bitcoin pioneer Jameson Lopp humorously queries about the well-being of gold investor Peter Schiff, indicating the growing divide between the two camps. Mike Alfred points out the stark performance contrast between Bitcoin and gold, anticipating further skepticism from Schiff, who remains critical of Bitcoin’s rally.

Indeed, Schiff continues to express skepticism about the BTC rally, attributing it to a “pump-and-dump” scheme. Despite this, BTC continues to trade at a robust $52,000, showcasing its resilience and growing appeal among investors.

In summary, the surge in Bitcoin ETFs and the corresponding outflows from gold ETFs signify a notable shift in investor preference towards digital assets. While this trend is indicative of changing investment strategies, it also underscores the ongoing debate between traditional and digital asset proponents.