It’s evident from Google search data that retail investors have yet to significantly engage in the Bitcoin market.

Bitcoin’s price has experienced a substantial uptrend in recent months, skyrocketing from below $20,000 to over $50,000 since June 2023.

Although this surge was primarily fueled by the anticipation and subsequent approval of nearly a dozen spot Bitcoin ETFs in the United States, retail traders have notably remained on the sidelines. This prompts the question of whether their participation could drive another surge in the asset’s price in the coming months.

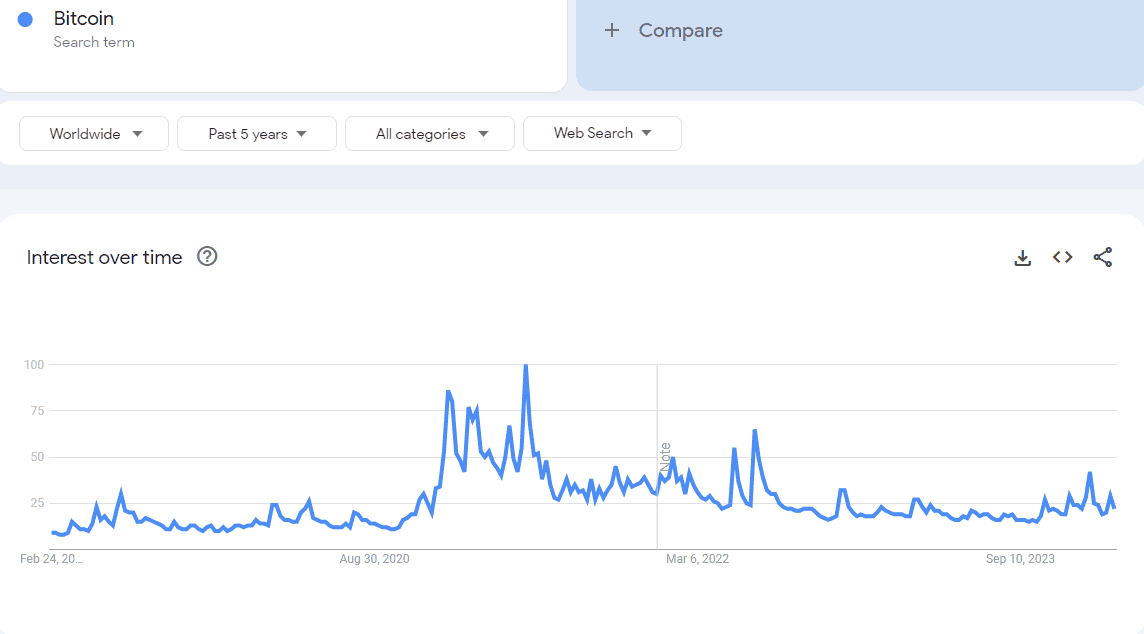

The Journey So Far Data derived from Google Trends illustrates the typical behavior of retail investors, who often exhibit heightened interest in investment opportunities during periods of significant market activity. This phenomenon, commonly referred to as FOMO (fear of missing out), typically results in increased market participation from retail investors.

The cryptocurrency market is particularly susceptible to such sentiment shifts, often experiencing rapid overheating when demand from retail investors surges. This typically leads to inflated prices followed by corrective phases as the market cools off.

The most recent cycle occurred in 2021, characterized by soaring prices and widespread retail investor involvement. However, the anticipated price milestones were not met, leading to a decline in Bitcoin’s value and a subsequent retreat of retail investors from the market.

Bitcoin began its recovery in June 2023 following BlackRock’s filing to launch its own spot BTC ETF. With BlackRock’s track record of success with ETFs, institutional interest in Bitcoin heightened, shifting the prevailing sentiment from skepticism about SEC approval to a more optimistic outlook.

This shift sparked increased hype and, consequently, a surge in prices, propelling BTC from under $20,000 in June 2023 to over $40,000 by early January. Subsequently, the approval of 11 spot BTC ETFs led to a “sell-the-news” moment, followed by renewed demand for cryptocurrency and a surge past $50,000 for the first time in over two years.

However, one crucial element appears to be missing.

Retail Participation Despite significant institutional interest and large-scale investments in Bitcoin, reports suggest that smaller retail investors have been offloading their BTC holdings. Google Trends data corroborates this trend, indicating that global searches for Bitcoin are well below the levels observed during the 2017 boom, the 2021 bull run, and even the 2022 market crashes.

Apart from a brief uptick in searches surrounding the ETF approvals in mid-January, search volumes have barely surpassed those observed during the 2019 bear market and the 2020 Covid-induced correction.

This indicates a notable absence of retail investors, despite Bitcoin’s price more than doubling since June last year. However, the upcoming halving event could potentially alter this dynamic, considering Bitcoin’s historical price performance following previous halvings.

Therefore, it will be intriguing to monitor whether retail investors will drive another rally, potentially propelling Bitcoin to achieve a new all-time high in the coming months.