On November 22, Polygon (MATIC) experienced a weekly low of $0.70, reacting to the regulatory turbulence surrounding Binance. Despite this setback, on-chain analytics reveal essential bullish indicators that may influence MATIC’s upcoming price movement.

MATIC achieved a five-month high of $0.98 on November 14, but a correction ensued this week amid the leadership changes at Binance. As the market gains momentum, the trajectory of MATIC’s price becomes a focal point.

Ecosystem Enhancements and Partnerships Attract Investor Attention

This month, the Polygon network has garnered notable investor interest due to advancements and strategic partnerships. Despite market uncertainty surrounding Binance’s leadership changes, MATIC’s demand remains stable.

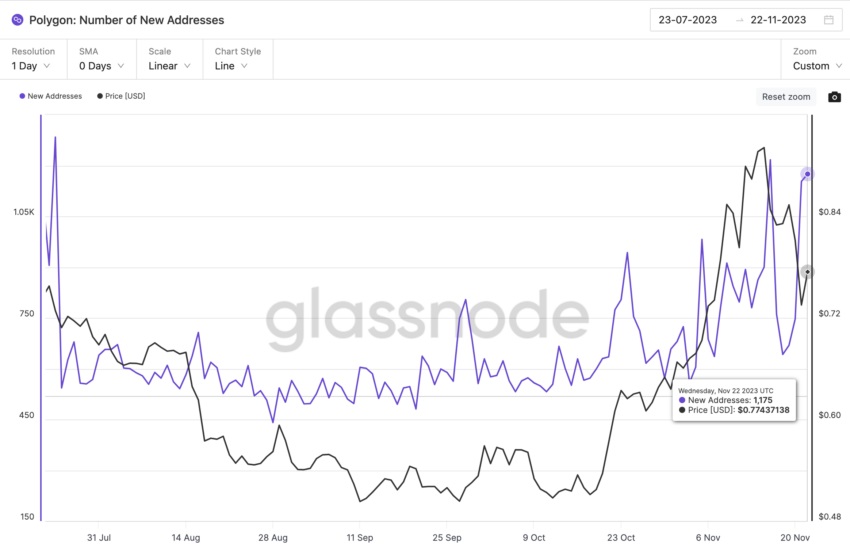

On November 22, the daily creation of new MATIC wallets reached 1,175 addresses, closely trailing the four-month high of 1,217 new addresses recorded on November 16, as per Glassnode’s on-chain chart.

Source: Glassnode

The metric of new addresses gauges how a blockchain network attracts users.

The increase in daily new MATIC wallets suggests growing demand for products and services on the Polygon network. This surge in new wallets, likely accompanied by fresh capital, stems from Polygon’s recent partnership announcements and network updates, especially concerning the POL token migration.

MATIC Demand Outpaces Selling Pressure Amid Market FUD Further affirming Polygon’s bullish growth, on-chain data indicates an accelerating buying momentum relative to selling pressure.

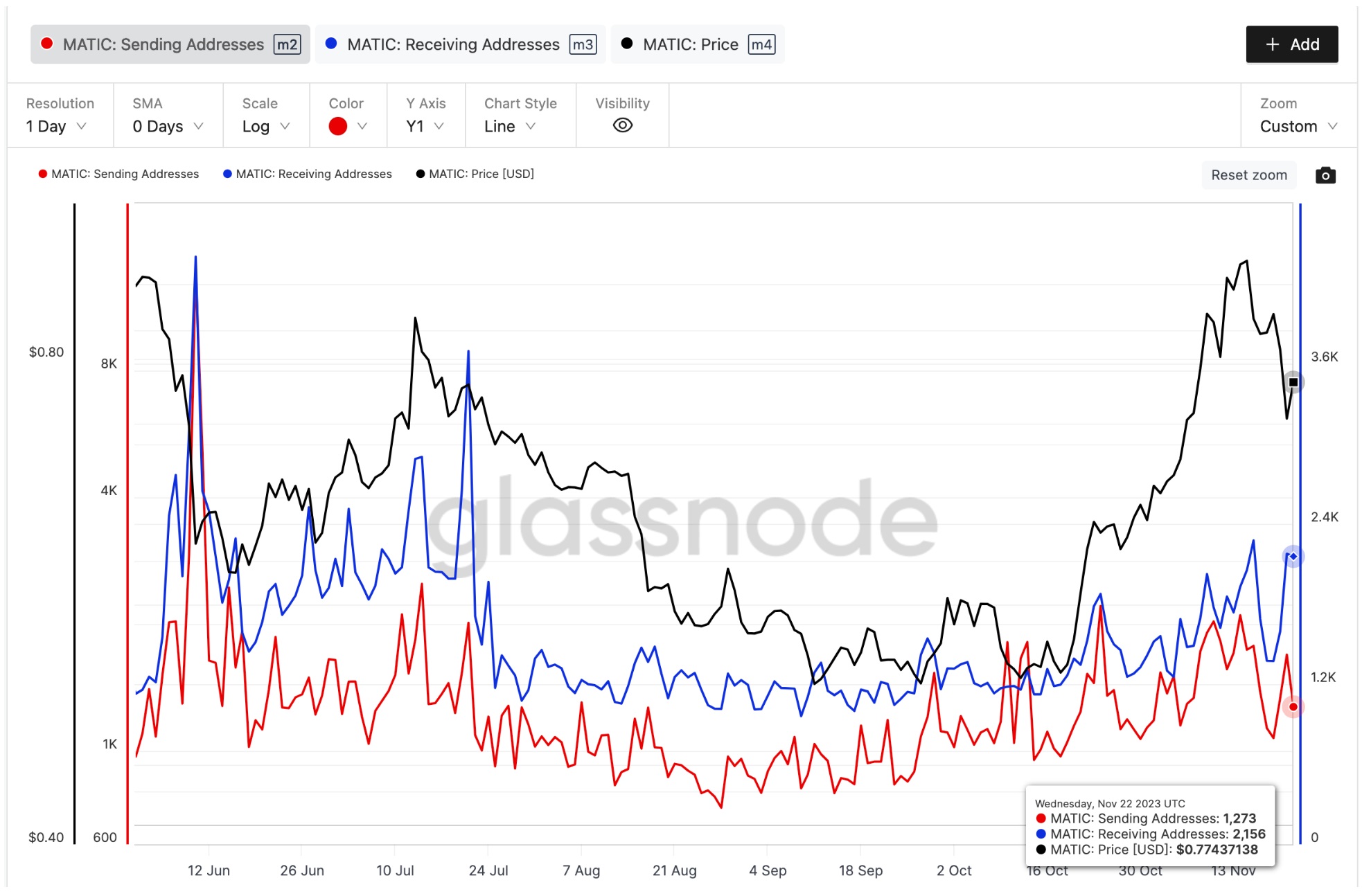

Despite a 36% retracement from the recent peak of $0.98, market demand for MATIC remains robust. Glassnode’s chart reveals that MATIC buyers (receiving addresses) outnumber sellers (sending addresses).

Source: Glassnode

Between November 20 and November 22, MATIC receiving addresses increased from 1,595 wallets to 2,156 wallets, while sending addresses marginally decreased from 1,335 to 1,273 wallets. This positive divergence between buyers and sellers suggests potential bullish momentum.

The receiving addresses metric reflects the number of unique wallets acquiring the token, while sending addresses represent existing holders actively transferring or selling their holdings. The bullish divergence played a crucial role in MATIC’s 7% rebound from the weekly low of $0.73 on November 21 to $0.78 at the time of writing on November 23.

If this alignment persists, MATIC’s bulls might regain control, potentially pushing for a retest of $0.90 in the coming days.

MATIC Price Outlook

Can it Reclaim $1? From an on-chain perspective, the increasing network demand stands out as a significant factor propelling buying momentum in MATIC markets this week. With these crucial metrics maintaining a bullish trend, MATIC’s price is well-positioned for another upward move.