With Ethereum’s recent surge above $3,900, many in the crypto sphere are speculating whether this marks the beginning of an “alt season,” where alternative cryptocurrencies outperform Bitcoin. Ethereum’s dominance in the market has been evident, especially following Bitcoin’s attainment of a new all-time high, leading to discussions about a potential shift in dominance.

Historically, when Ethereum performs strongly, it tends to catalyze a broader uptrend in the altcoin market. This time seems to be no exception, as evidenced by the flow of capital into various altcoins, including Render (RNDR), Fetch.ai (FET), and Fantom (FTM). Notably, these altcoins are all ERC-20 tokens, indicating heightened interest not only in Ethereum but also in assets connected to its network.

Analyzing whale transactions valued over $100,000, it’s apparent that significant capital has been moving into these altcoins since early March. This influx of capital, particularly in the last 24 hours, suggests the potential arrival of the much-anticipated altcoin season.

Source: Santiment

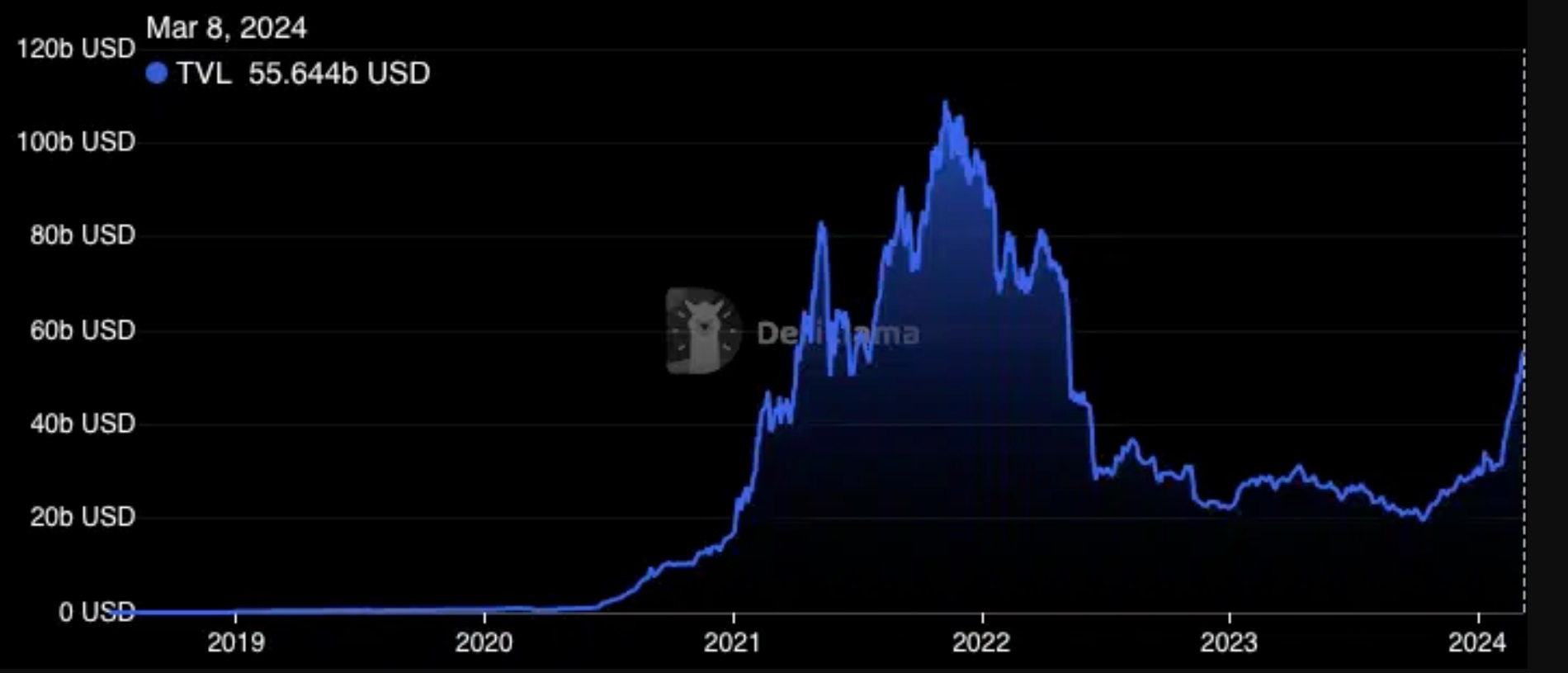

The Total Value Locked (TVL) in Ethereum further substantiates this narrative. Over the last 30 days, Ethereum’s TVL has surged by an impressive 73.78%, reaching $55.30 billion. The TVL serves as a crucial metric reflecting the health of a blockchain protocol. An increase in TVL indicates growing confidence among market participants, leading to a steady influx of liquidity. This surge in Ethereum’s TVL underscores the positive sentiment surrounding the network, potentially setting the stage for further price appreciation.

If the trend of capital inflow into Ethereum and its associated assets persists, Ethereum’s TVL could approach its previous all-time high. Such a development could drive Ethereum’s price above $5,000, signaling a significant milestone in the ongoing bull market.

Source: DeFILlama

Moreover, the positive momentum in Ethereum could spill over to other altcoins. Tokens like Fetch.ai (FET), which has witnessed a remarkable 377% increase in the last 90 days, and Fantom (FTM), which may see a surge toward the $3 mark, could experience further upside potential. Similarly, Render (RNDR) could also witness an upward trajectory in its price.

In conclusion, Ethereum’s recent surge also amid BlackRock’s Spot Ethereum ETF buildup, and the subsequent increase in altcoin activity suggest a potential shift in market dynamics. As capital continues to flow into Ethereum and its associated tokens, the broader altcoin market could see considerable upside, potentially signaling the onset of a full-fledged alt season.