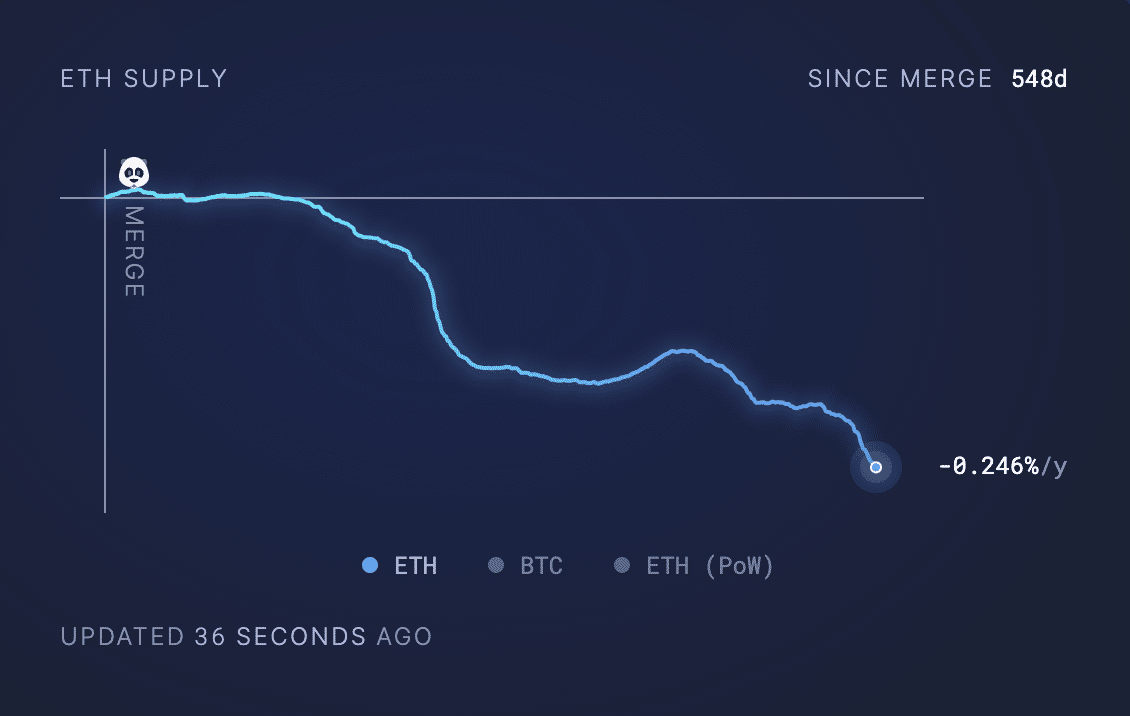

Once again, Ethereum finds its circulating supply hitting a new low post-merge, indicating a significant shift in the ecosystem.

The surge in demand for the Ethereum network has accelerated the burn rate of its native currency, leading to a steady decline in its circulating supply.

Data from Ultrasound.money highlights Ethereum’s circulating supply hitting a new post-merge low, with approximately 86,219 ETH—equivalent to roughly $300 million at current prices—being removed from circulation in the past month alone.

This reduction in Ethereum’s circulating supply underscores the increasing demand and usage of its Proof-of-Stake (PoS) network, contributing to a higher burn rate.

Recent statistics show that the daily creation of new addresses on the Ethereum network has surpassed 116,000, marking a year-to-date high and signaling heightened user activity on its Layer 1 network.

Currently, Ethereum’s circulating supply stands at 120.07 million ETH, marking the lowest level in 548 days since the network’s transition from Proof-of-Work (PoW) in “The Merge” event.

Source: Ultrasound.money

Ecosystem Performance and Trends

An analysis of Ethereum’s decentralized finance (DeFi) ecosystem reveals a notable increase in total value locked (TVL) over the past month, reaching $51 billion at present—a 21% rise in 30 days. Leading protocol Lido Finance witnessed a 27% increase in TVL during this period.

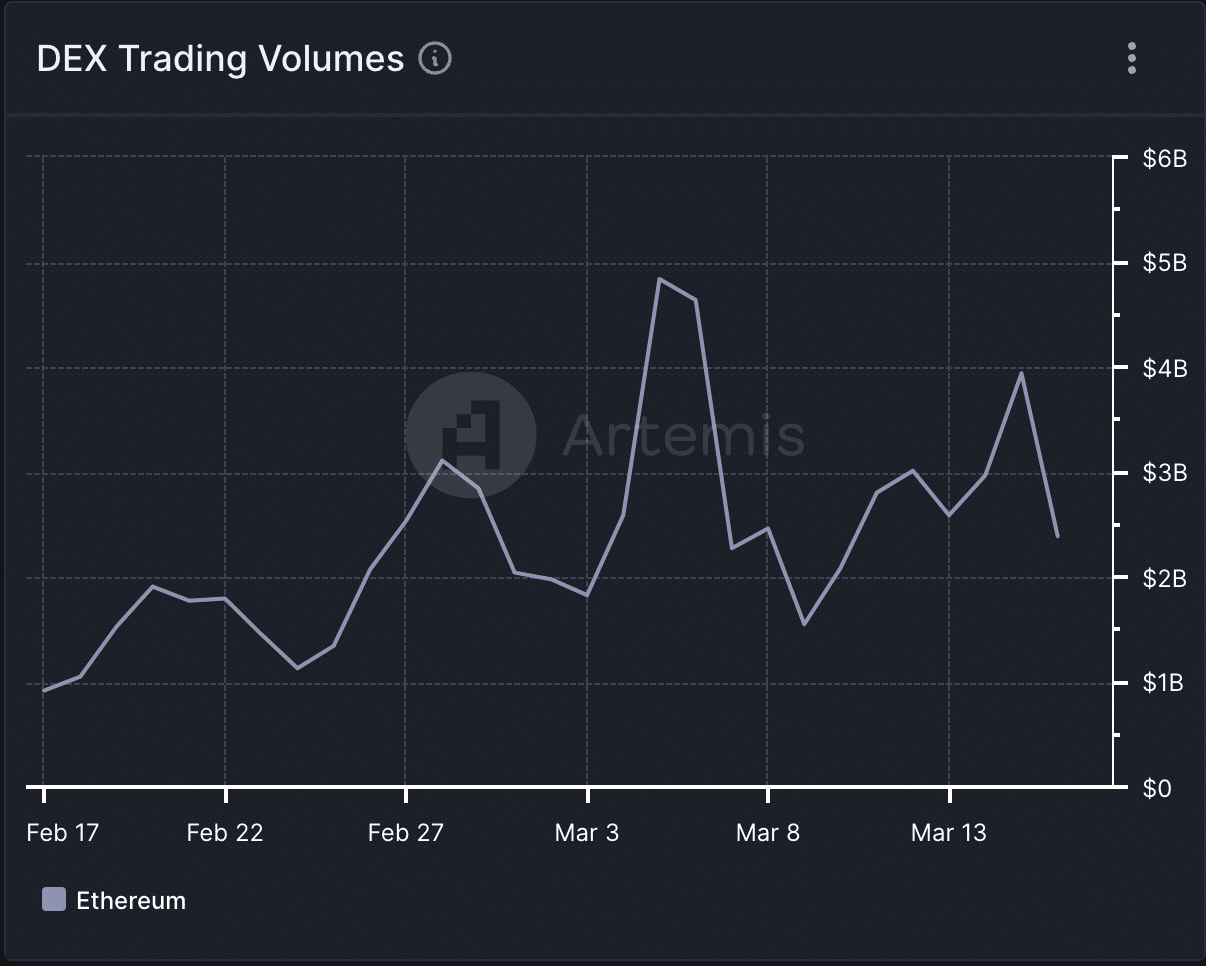

In tandem with the broader altcoin market rally, Ethereum experienced a surge in decentralized exchange (DEX) trading volumes. Data from Artemis indicates a 161% increase in daily trading volume across Ethereum’s DEXes over the past month.

Source: Artemis

Even the non-fungible token (NFT) sector within Ethereum saw growth, with NFT sales volume totaling $617 million in the past 30 days—a 17% increase despite a 57% decrease in the number of completed NFT sales transactions.

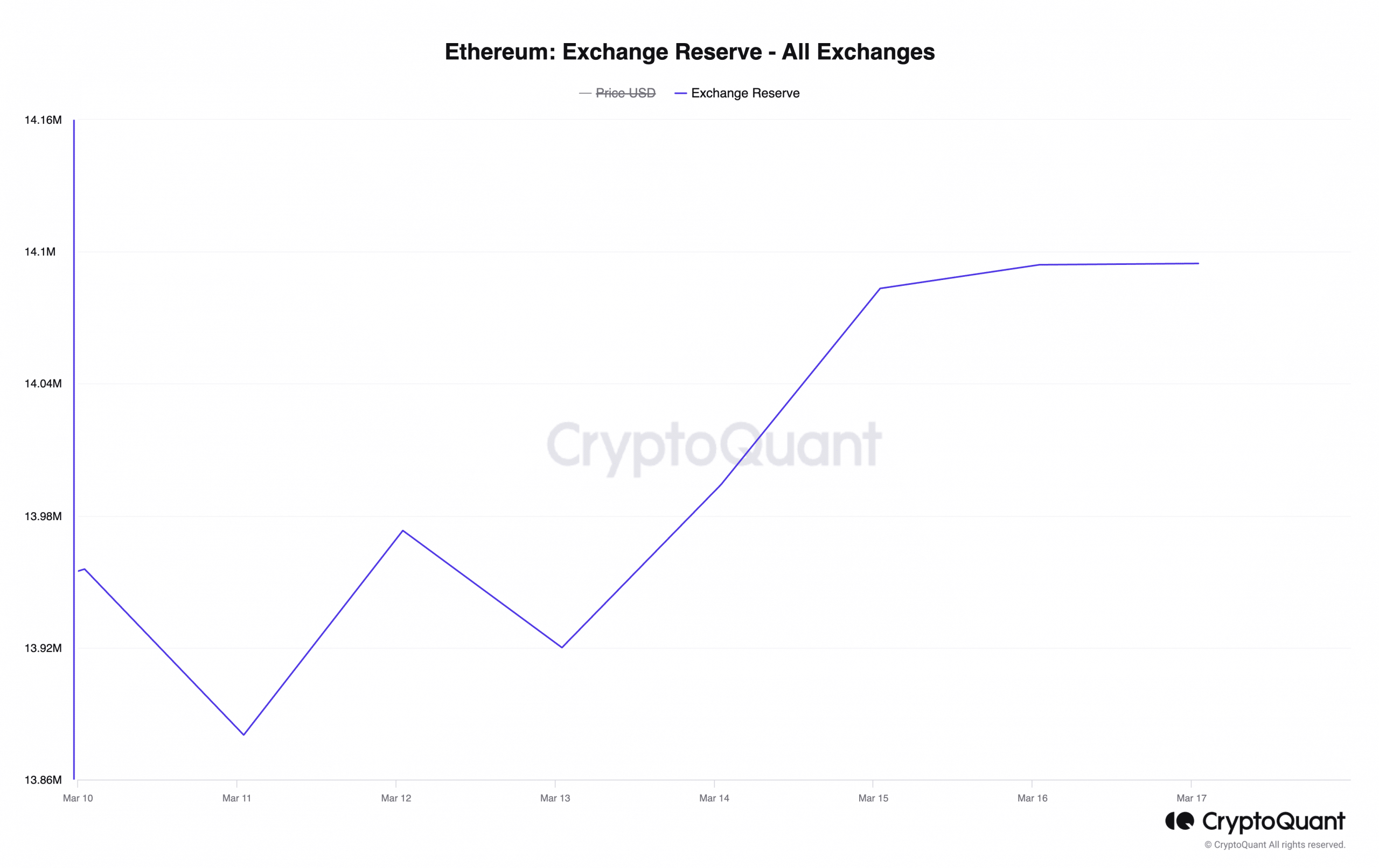

Exchange Reserves Surge

However, amidst this growth, there’s a notable uptick in Ethereum’s supply on exchanges. As indicated by CryptoQuant’s data, Ethereum’s exchange reserve stands at 14.1 million, marking a one-month high.

This increase in exchange reserves suggests heightened selling pressure on Ethereum as the broader crypto market sentiment becomes increasingly greedy, as depicted by the crypto fear & greed index.

Source: CryptoQuant

In conclusion, while Ethereum’s network continues to experience robust activity across its DeFi, DEX, and NFT sectors, the significant reduction in its circulating supply points towards increasing demand and utility, albeit amidst rising selling pressures and market greed.