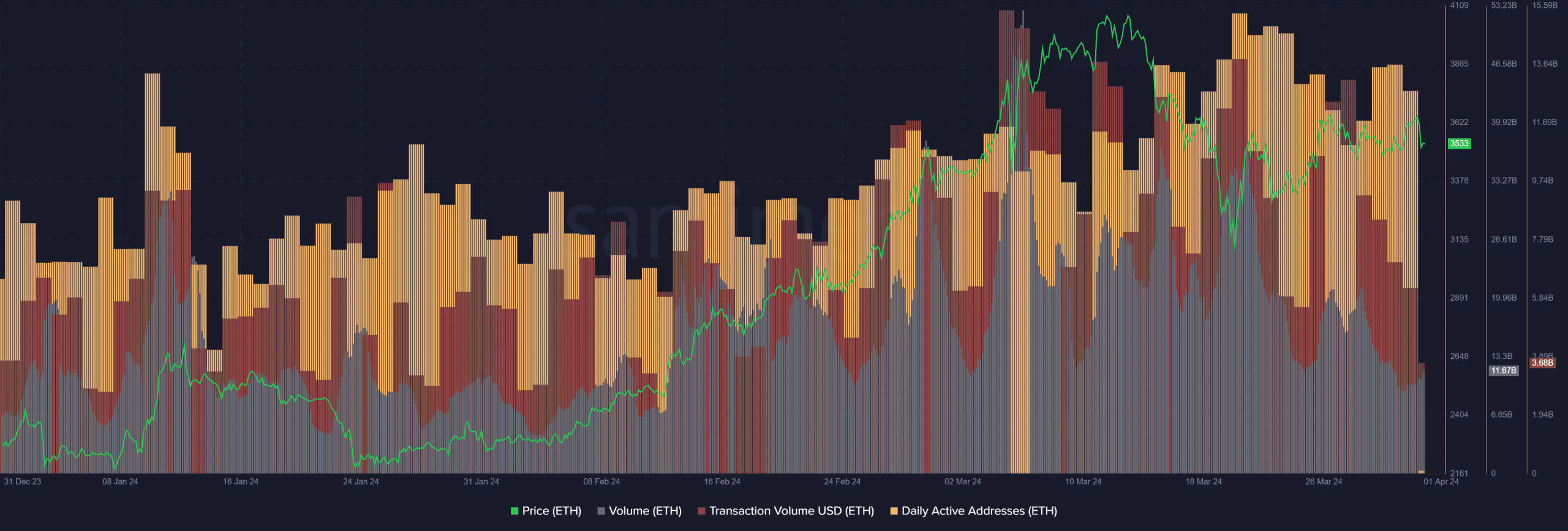

Ethereum (ETH) has exhibited notable price movements, rallying by 82% from February 1st to March 12th, only to retrace to $3056 before rebounding to $3680. This fluctuation echoes patterns observed in January, suggesting a potential consolidation phase.

Examining key metrics reveals intriguing patterns indicative of a bullish sentiment and robust network health.

During the rally, both trading volume and active addresses reached notable peaks, resembling a surge in activity reminiscent of previous bullish periods. Despite the subsequent retracement, active addresses remained elevated, reflecting sustained interest even amidst price fluctuations.

Source: Santiment

Notably, just prior to the price correction, trading volume surged to levels unseen in over six months, accompanied by a significant uptick in daily active addresses. This heightened activity underscored intense bullish sentiment, driving increased demand for Ethereum.

Interestingly, despite the price slump, daily active addresses continued to remain high, highlighting sustained engagement within the Ethereum ecosystem. Conversely, trading volume experienced a significant decline, mirroring previous market patterns.

Moreover, on-chain transaction volume exhibited a similar trajectory, peaking during periods of price highs and stabilizing during retracements, indicative of underlying resilience within the network.

This trend coincides with a swift recovery witnessed after Ethereum’s dip to $3056, suggesting the possibility of a bullish continuation akin to February’s market dynamics.

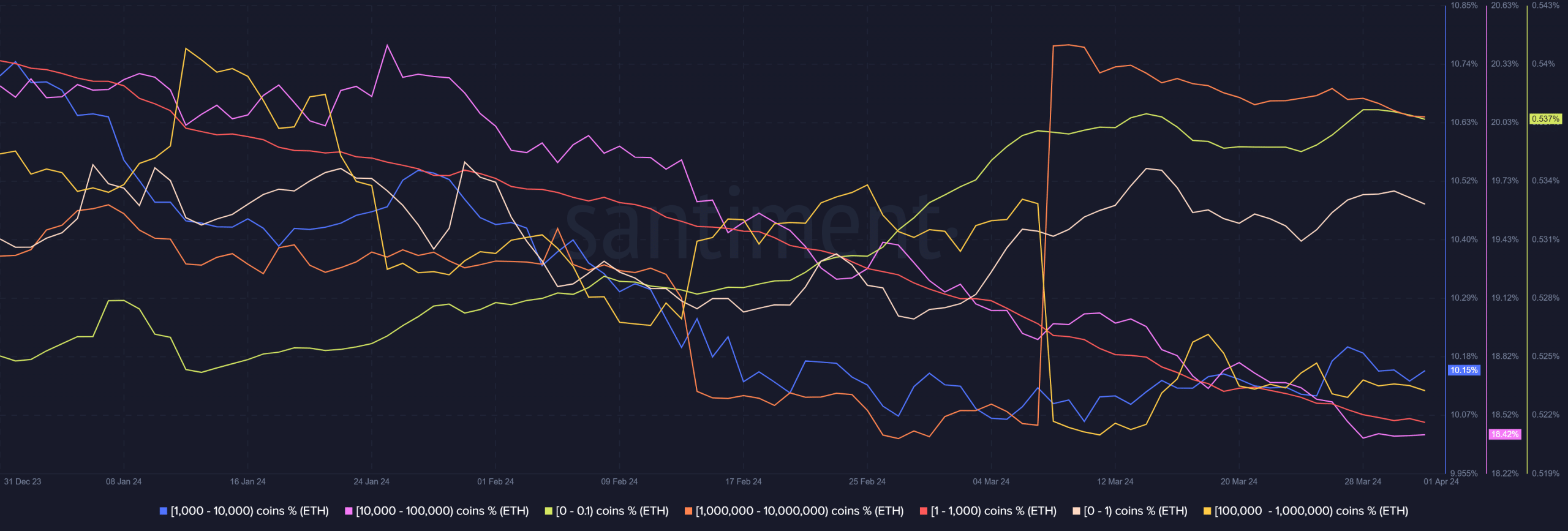

Further analysis of supply distribution offers additional insights, particularly regarding the behavior of whales and smaller holders. While medium-sized holders demonstrated a propensity to sell, whales and smaller holders exhibited a contrasting pattern, actively accumulating Ethereum assets.

Source: Santiment

Notably, the increasing accumulation by whales and smaller holders, juxtaposed with the decline in medium-sized holdings, signifies a growing inclination towards HODLing among smaller Ethereum holders.

In conclusion, Ethereum’s current market dynamics underscore the potential advantages of strategic HODLing, particularly amidst fluctuating market conditions. As April unfolds, maintaining a long-term perspective could prove to be a prudent strategy for Ethereum investors.