Crypto firm Circle gets MiCA approval for stablecoin issuance in the EU.

Circle has secured regulatory approval in the European Union for its stablecoin under the Markets in Crypto-Assets (MiCA) framework, marking a significant milestone. However, the network growth for both USDC and USDT has declined.

Circle Gains Regulatory Approval

Despite Circle’s USDC experiencing growth over recent months, it has lagged behind Tether’s USDT in terms of market cap. Nevertheless, recent developments could elevate USDC’s status in the market.

In a significant step for regulatory clarity in the digital asset sector, Circle announced on July 1st that it has received the first regulatory approval for its stablecoins under the EU’s MiCA framework. Jeremy Allaire, Circle’s co-founder and CEO, revealed that this approval provides reassurance to investors holding Circle’s USDC and EURC stablecoins, ensuring their compliance with new regulations. This development alleviates concerns that investors might need to redeem their holdings or move them to other assets to remain compliant.

BREAKING NEWS: @Circle announces that USDC and EURC are now available under new EU stablecoin laws; Circle is the first global stablecoin issuer to be compliant with MiCA. Circle is now natively issuing both USDC and EURC to European customers effective July 1st.

Details… pic.twitter.com/isNBumoi3e

— Jeremy Allaire – jda.eth (@jerallaire) July 1, 2024

Circle Expands into Europe

Circle also revealed its decision to establish France as its European headquarters, citing France’s progressive stance on digital asset regulation and its positive relationship with the French Prudential Supervision and Resolution Authority (ACPR) as key factors.

Allaire emphasized the importance of MiCA, the EU’s first comprehensive regulatory framework for digital assets, noting that it signifies a major advancement for the legitimacy and stability of stablecoins and the maturation of the digital asset industry.

Can USDC Outperform USDT?

At the time of the announcement, Circle’s USDC held a 20% market share with a market cap of $32 billion. In contrast, Tether’s USDT dominated with a 70% market share and a market cap of $112 billion. Circle’s regulatory approval in Europe could be a pivotal moment, potentially increasing demand for USDC and helping it to close the gap with Tether.

This advantage is particularly crucial for Circle, which has been steadily losing market share to Tether. By being the first to achieve regulatory compliance, Circle can position USDC as a secure and reliable option for European investors, particularly those cautious about the unregulated cryptocurrency market. This development could drive significant demand for USDC, not just in Europe but globally.

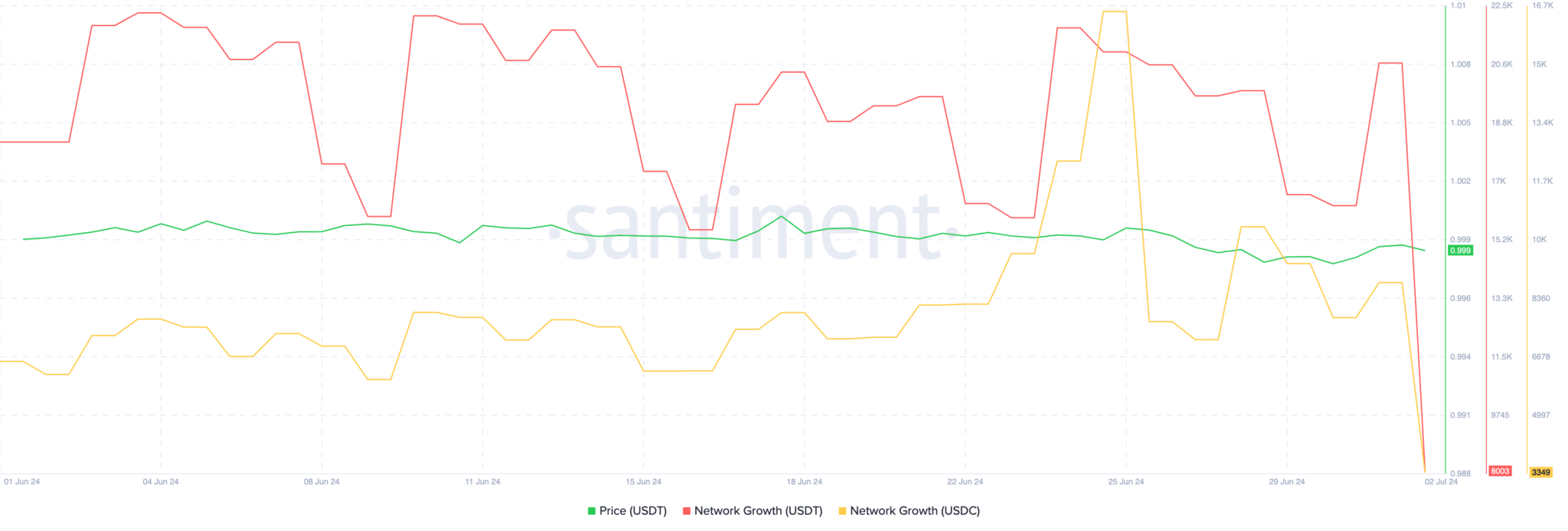

Despite this positive news, Santiment data indicates that the network growth for both USDC and USDT has declined recently, suggesting a temporary drop in the number of new addresses for these stablecoins.