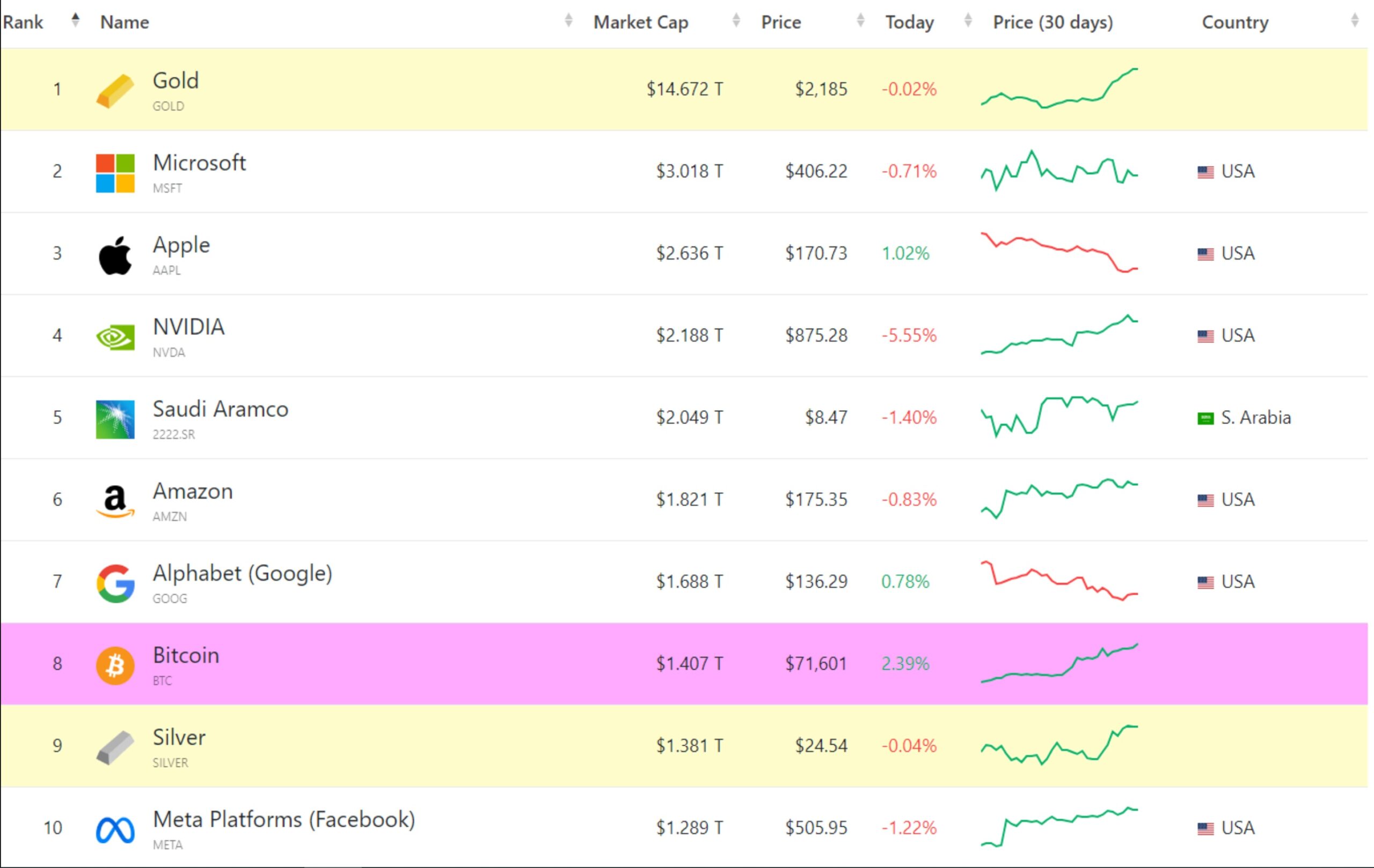

In a resounding testament to its resilience and meteoric rise, Bitcoin (BTC) has once again shattered records, surging past the $71,000 mark to establish a new all-time high just shy of $72,000. This milestone not only signifies a remarkable 60% surge since the beginning of the year but also propels Bitcoin’s total market capitalization beyond $1.4 trillion, solidifying its position as the 8th largest financial asset globally.

Rewind to March 11, 2023, and the narrative surrounding Bitcoin was vastly different. Priced at a modest $20,000 following a setback from the $30,000 mark, skeptics were quick to dismiss its role as a hedge against inflation or a reliable financial instrument in times of uncertainty. Yet, Bitcoin defied expectations, swiftly regaining momentum in the ensuing months.

June of the same year brought a pivotal moment with BlackRock, the world’s largest asset manager, announcing its intentions to launch a spot Bitcoin exchange-traded fund (ETF). This announcement proved to be a game-changer, injecting renewed optimism into the market. Fast forward to January 2024, and the Securities and Exchange Commission (SEC) approved nearly a dozen Bitcoin ETFs, fueling unprecedented demand and driving Bitcoin’s price to new heights.

Last week marked another historic milestone as Bitcoin shattered its 2021 all-time high just ahead of a scheduled halving, a momentous occasion that set the stage for further price appreciation. Today, Bitcoin’s ascent to nearly $72,000 underscores its unwavering momentum and solidifies its status as a formidable financial asset.

As Bitcoin’s market capitalization eclipses $1.4 trillion, it now surpasses established giants such as Meta (formerly Facebook) and silver, the world’s second-largest commodity. However, the question remains: who’s next?

With formidable contenders like Alphabet and Amazon looming on the horizon, Bitcoin faces an uphill battle to surpass these corporate behemoths. To overtake Google’s parent company, Bitcoin’s price would need to exceed $85,000, representing a 20% increase. Similarly, surpassing Jeff Bezos’ corporate empire would require Bitcoin to surge past $94,000, marking a 30% increase from its current levels.

Yet, the ultimate prize remains gold, the quintessential store of value and a benchmark for financial stability. Surpassing gold would necessitate a monumental leap, with Bitcoin’s price soaring to an unprecedented $700,000. While such figures may seem ambitious, Bitcoin’s track record speaks volumes, having surged more than 60% since the start of 2024 and 40% in the past two weeks alone.

As Bitcoin continues to redefine the financial landscape, its ascent underscores the transformative potential of decentralized digital assets. While challenges lie ahead, the journey towards widespread adoption and mainstream recognition is well underway, with Bitcoin leading the charge towards a more inclusive and resilient financial ecosystem.