The altcoin market is likely to remain stagnant amid expectations of Bitcoin’s rise to $100,000.

Despite persistent bearishness in the altcoin sector and a lack of significant growth drivers, analysts predict potential recovery only after Bitcoin reaches the $100,000 milestone.

Current State of the Altcoin Market

The cryptocurrency market has seen a substantial downturn in altcoins, struggling to gain traction as Bitcoin [BTC] dominates investor focus.

Recently, the altcoin market cap has dropped significantly from its late May peak of $1.182 trillion to just over $1.06 trillion. This decline reflects a cautious and bearish sentiment among investors, attributed to the absence of compelling new narratives, as noted by analyst Crypto Ash.

Bitcoin’s Role in the Market

Crypto Ash highlighted that the eagerly awaited ‘Mega Altseason’ remains out of reach, with the total altcoin market cap falling to levels unseen since December 2023. He attributes the stagnation to the lack of significant market drivers similar to those seen in previous cycles. According to Crypto Ash, substantial altcoin rallies hinge on Bitcoin’s performance, suggesting that a true altcoin season might only begin once Bitcoin hits $100K.

During this period, he advises accumulating undervalued utility-based tokens. While retail interest is low, savvy investors and whales are positioning themselves strategically, indicating a buildup in anticipation of future gains.

Insights from Crypto Analysts

Crypto Distilled, another crypto analyst, emphasized the necessity of liquidity, particularly from stablecoins like Tether [USDT], which are crucial for altcoin liquidity on decentralized exchanges (DEXes). He noted that USDT growth has been minimal since February 11, and a resurgence in stablecoin liquidity is essential for a sustainable altcoin price rally.

Additionally, Crypto Distilled recommended monitoring the Smart Contract Platforms index, as these platforms play a significant role in decentralized applications (dApps) and market trends. Layer 1 governance tokens add liquidity to their ecosystems, and the potential introduction of an Ethereum [ETH] ETF could be a major liquidity driver.

Crypto analyst Jamie Coutts identified two key indicators to watch: an uptrend in the Smart Contract Platforms (SCP) sector and a rise in the Altseason Index. Historically, the alignment of these trends has signaled significant gains for altcoins, often exceeding tenfold returns.

Market Dynamics and Investor Behavior

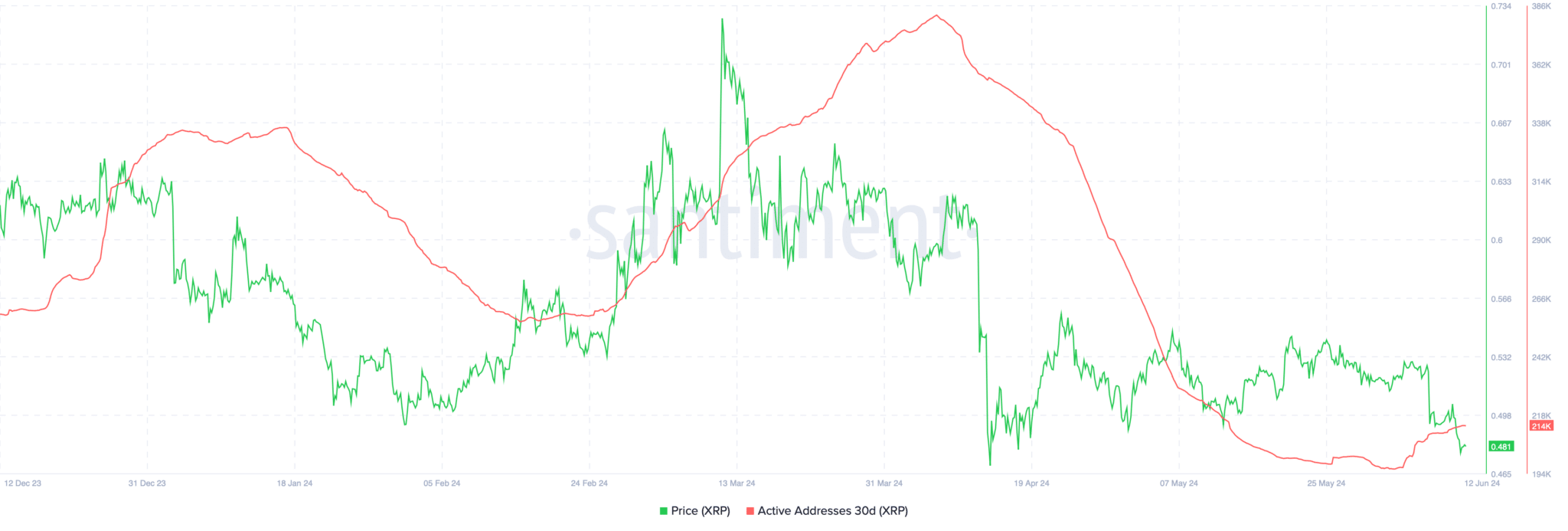

The disparity between Bitcoin and altcoin performance is stark. As Bitcoin nears its all-time highs, altcoins are struggling, reflecting bear market conditions. This divergence is evident in the performance metrics of leading altcoins like XRP, which has seen nearly a 10% decline in recent weeks.

Santiment data revealed a significant drop in active XRP addresses, suggesting waning user engagement and potentially further price declines. Despite this downturn, there is a silver lining as the number of XRP holders increased by 100,000 in early June, hinting at underlying interest despite current market challenges.

Source: Santiment

Future Outlook

The altcoin market faces short-term headwinds, but the groundwork for future rallies may be forming behind the scenes. As investors recalibrate their strategies in response to evolving market dynamics, the potential for a significant altcoin resurgence remains on the horizon, contingent on Bitcoin reaching new heights.