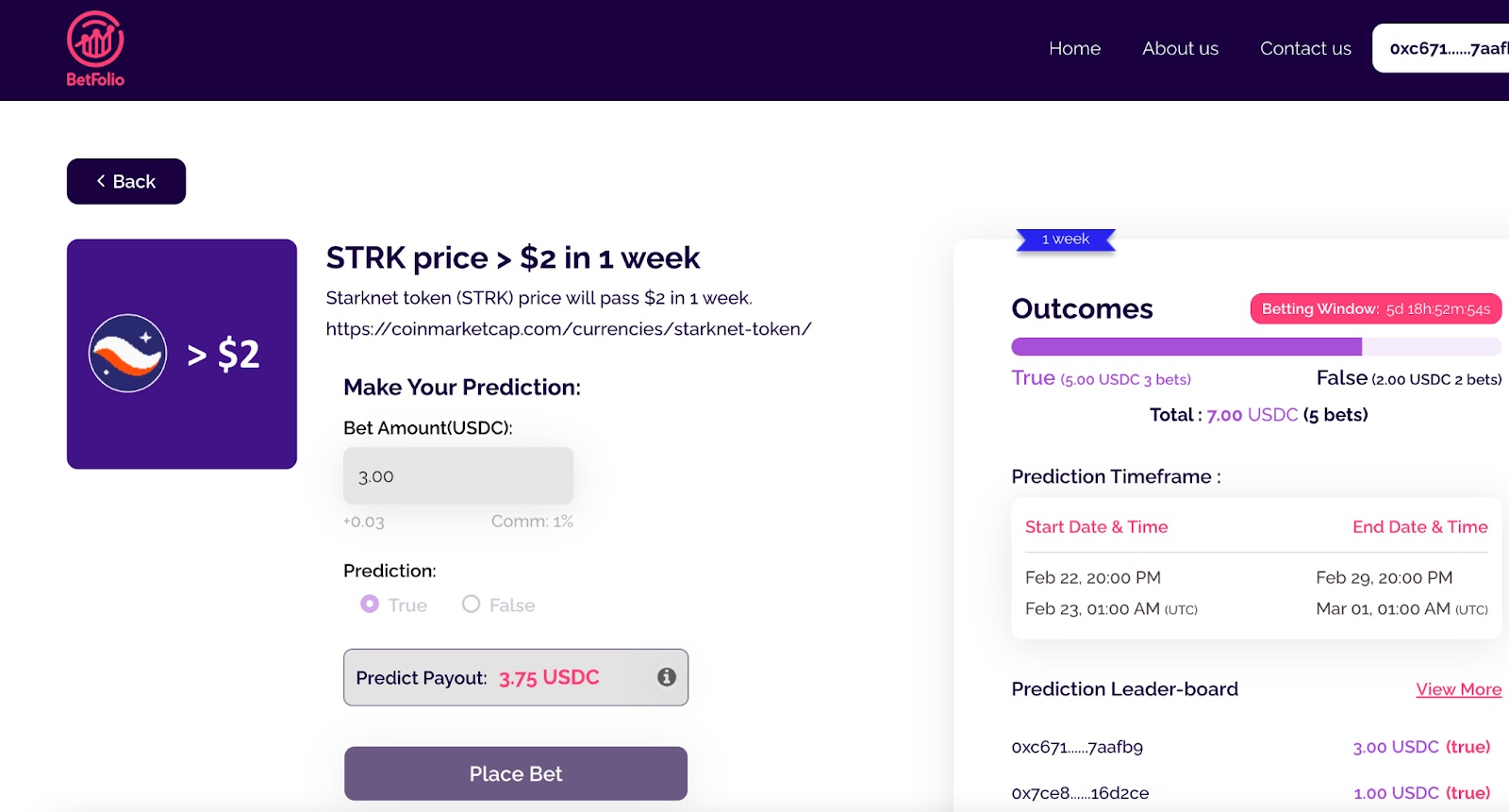

The initial downturn in Starknet’s STRK token price following its launch has incited varied responses within the market. However, upon closer examination of the fundamental elements at play, there emerges a compelling case for an imminent resurgence. Here, we delineate the factors indicating the potential for the STRK price to recover and surpass the $2 threshold in the coming week.

Do you agree with this analysis? Share your perspective on BetFolio’s prediction platform.

Robust Technical Framework

Starknet operates on state-of-the-art zero-knowledge proof technology, thereby markedly enhancing Ethereum’s scalability. This robust technical framework stands as a cornerstone for sustained success, capable of drawing in a greater number of developers and projects, consequently amplifying the demand for STRK.

Community and Developer Endorsement

Despite the initial wave of sell-off, Starknet boasts an ardent community and substantial developer endorsement, with an excess of 100,000 wallets having claimed STRK. This community has the potential to drive recuperation through heightened adoption and the exploration of various applications.

Market Corrections and Price Dynamics

Echoing the trajectories of other tokens suffering price drops post-launch, STRK’s price dynamics might mirror a corrective pattern observed within the realm of other cryptocurrencies, wherein initial sell-offs are succeeded by robust recoveries as the early volatility subsides.

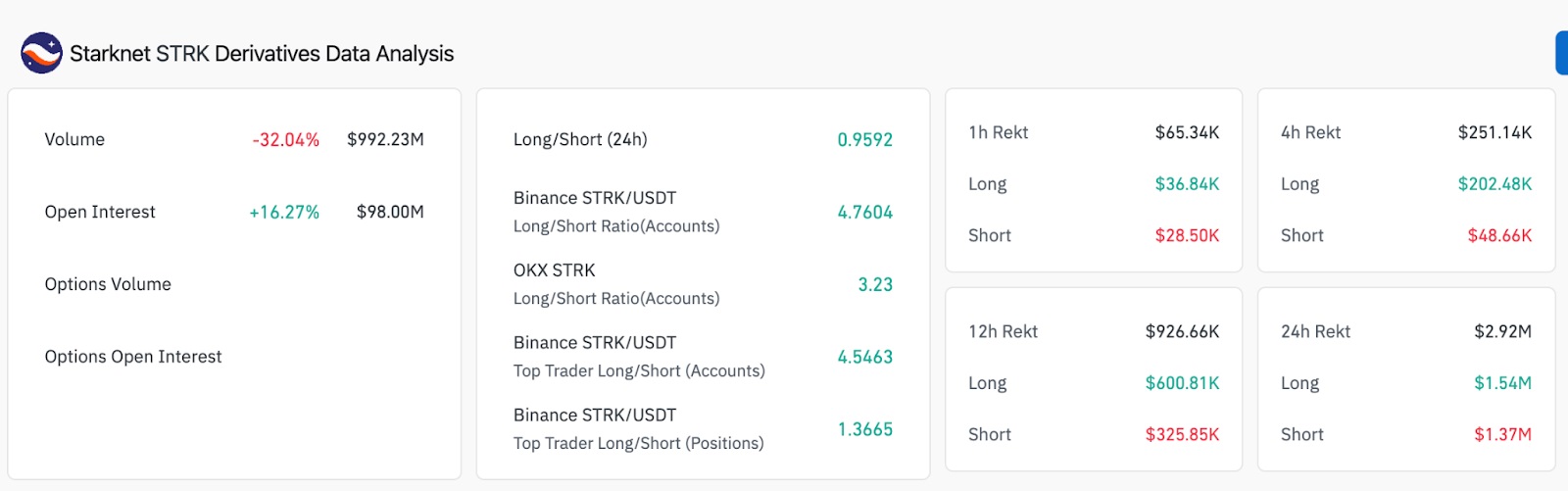

Derivative Market Analysis

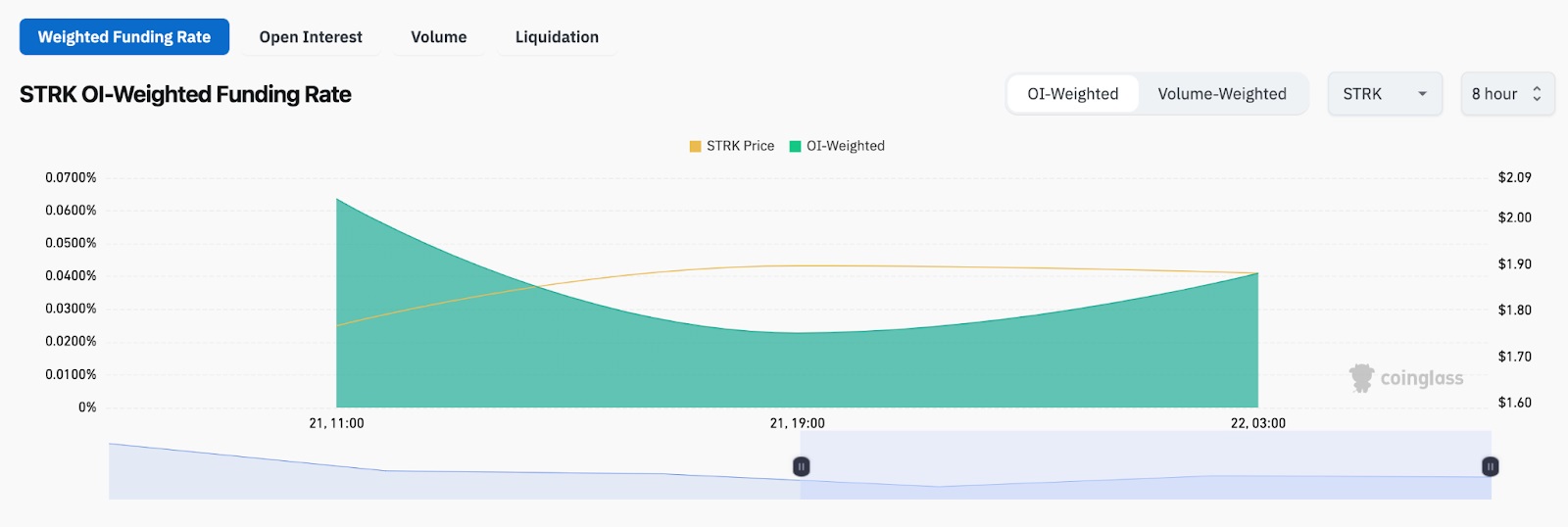

Analysis of derivative markets pertaining to the STRK token reveals a heightened long/short ratio across all temporal frames, indicative of an overall bullish sentiment despite the initial divestiture.

Moreover, positive open interest weighted funding rates typically signify that a majority of market participants retain long positions and are willing to pay a premium to uphold said positions.

Allocation for Ecosystem Development

A notable portion of the STRK supply is earmarked for community airdrops, grants, and donations. This strategic allocation has the potential to cultivate a resilient ecosystem surrounding Starknet, thereby propelling the utility and worth of STRK in the medium to long term.

Foreseen Unlock Schedules

While the token unlock schedule has attracted criticism, it also holds the potential to engender predictable market dynamics. Investors may perceive forthcoming unlocks as opportunities for heightened liquidity and potential price stabilization.

Overall Market Sentiments

The crypto market is susceptible to broader market sentiments and extrinsic factors. Positive shifts in these domains, attributed to the anticipated approval of Ethereum ETFs and reductions in interest rates, could bolster investor confidence and contribute to a resurgence in STRK’s price.

Strategic Collaborations and Announcements

Any fresh partnerships, integrations, or announcements pertaining to Starknet’s development and adoption could serve as catalysts for price recovery, particularly if they underscore new utilities or heightened demand for STRK.

In summation, notwithstanding the initial criticisms and price volatility accompanying the issuance of STRK tokens, several factors indicate the potential for recuperation. The underlying technology, community support, strategic allocations, and prospects for favorable market dynamics collectively portend a promising trajectory for STRK in the near term.