The captured value on Polygon witnessed a significant surge in recent days, with MATIC exhibiting a 4% increase, although certain metrics displayed bearish tendencies. The surge in network activity on Polygon, particularly in daily transactions, contributed to profitable outcomes for MATIC stakeholders.

Polygon, as reported by Sandeep Nailwal, co-founder of the platform, achieved a notable milestone by processing over 17 million transactions in a single day, leading to a sharp spike in daily transaction counts.

I am not sure if a lot of ppl noticed that Polygon POS smoothly processed 17mn transactions in a single day, generated 1.2mn revenue for the stakers. Insane!

Shout out to core devs, validators and everyone participating in running the network🔥🔥 pic.twitter.com/ZAV2gQAEjb

— Sandeep Nailwal | sandeep. polygon 💜 (@sandeepnailwal) November 18, 2023

This accomplishment can be attributed to various developments, including an 8-month high in daily DEX volume exceeding $400 million on the Polygon PoS, integration of Chainlink CCIP across Ethereum and Polygon by ChainGPT, and the launch of the first-ever USDC-denominated structured investment product on Polygon by Obligate, focusing on regulated DeFi.

NEW:

Polygon PoS DEX volume has increased 250% over the last 2 months. pic.twitter.com/E5T1VohE9K

— Today In Polygon (@TodayInPolygon) November 18, 2023

In conjunction with the rise in network activity, Polygon’s captured value experienced a corresponding increase, evident from the heightened fees and revenue. Sandeep Nailwal reported that the blockchain generated $1.2 million in revenue for stakeholders during the peak transaction period.

I am not sure if a lot of ppl noticed that Polygon POS smoothly processed 17mn transactions in a single day, generated 1.2mn revenue for the stakers. Insane!

Shout out to core devs, validators and everyone participating in running the network🔥🔥 pic.twitter.com/ZAV2gQAEjb

— Sandeep Nailwal | sandeep. polygon 💜 (@sandeepnailwal) November 18, 2023

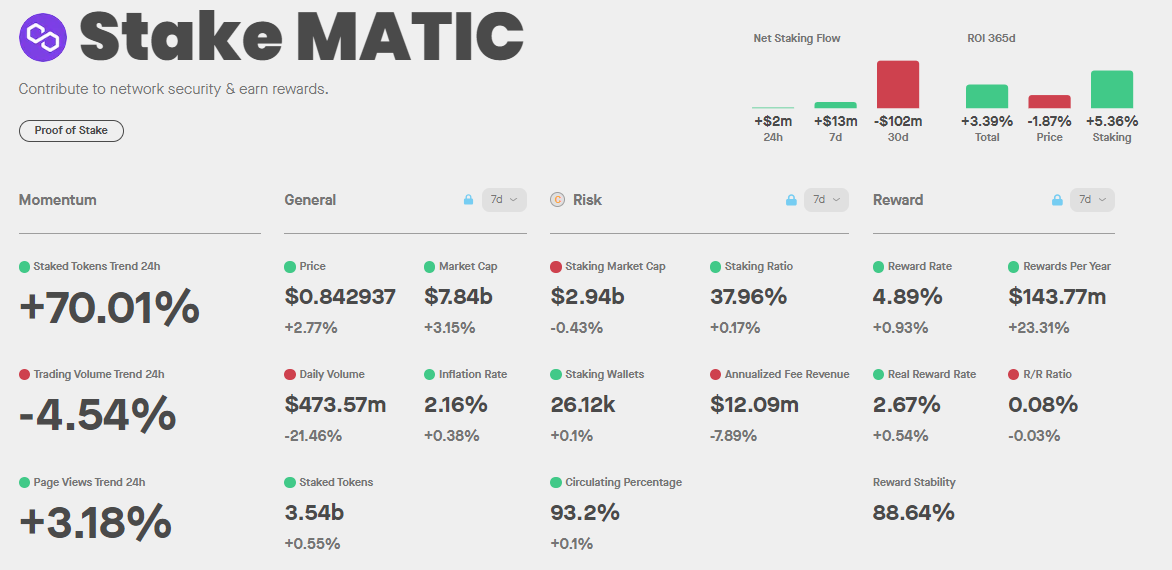

An analysis of MATIC’s staking ecosystem revealed a positive performance. Following a notable decline, the total number of staked MATIC gained momentum, reaching 26.1k wallets with a staking ratio of 37.9%. As of the latest update, MATIC’s staking market capitalization surpassed $2.94 billion.

MATIC bullish sentiment

Despite the favorable performance in various domains, MATIC investors celebrated a price surge of over 4.5% in the last 24 hours, according to CoinMarketCap. At the time of reporting, MATIC was trading at $0.8641 with a market capitalization exceeding $8 billion.

An analysis by Dailycoinpost indicated that the positive trend in MATIC’s price might encounter challenges in its sustainability. The observed increase in the token’s exchange reserve suggested heightened selling pressure. MATIC’s MVRV ratio witnessed a substantial decline in the past week, and the social volume associated with the token also experienced a slight reduction.

Nevertheless the overall bullish sentiment in the crypto markets, the metrics related to MATIC’s derivatives portrayed a bullish outlook. Notably, the Open Interest for MATIC increased in tandem with its price, enhancing the likelihood of a continuation of the prevailing market trend. Consequently, the prospect of MATIC maintaining its bullish rally cannot be discounted at this juncture.