Curious about why Bitcoin isn’t skyrocketing to the anticipated $70k+? Let’s break it down.

Recent Market Movements

Last week, Bitcoin’s excitement hit euphoric levels, particularly with the buzz surrounding the Bitcoin 2024 conference. However, this week has seen a different story, with BTC’s price taking a hit and dropping to $63,600. The exuberance of the previous week has been replaced by a more cautious and somber tone in the market.

Influencing Factors

Several factors are contributing to the current sell pressure. Firstly, the liquidation of long positions has played a significant role. Bitcoin had rebounded roughly 30% from its July lows, which gave short-term traders an incentive to cash out and lock in profits. This profit-taking has added to the downward pressure on BTC’s price.

Potential Pivot Points

An analysis using the Fibonacci retracement suggests that the next significant price points could be between $61,868 and $59,958 if the selling continues. This technical analysis indicates that Bitcoin might find some support around these levels, but the continuation of the downtrend remains a possibility if sell pressure persists.

The Hype Recession

The politically charged hype of the previous week has now subsided, and the market is taking a more cautious stance. This cautiousness is largely due to the upcoming Federal Open Market Committee (FOMC) data and the Federal Reserve’s upcoming meeting. Economic uncertainties often lead traders to exit their positions and wait for clearer signals, possibly explaining the current profit-taking trend.

Uncertainty around economic announcements tends to influence investment decisions significantly. Traders and investors often prefer to stay on the sidelines during such periods, leading to reduced buying activity and increased selling pressure. This cautious approach has likely contributed to the current state of the market.

Mt. Gox’s Influence

Adding to the sell pressure, new data from Mt. Gox has raised concerns. Lookonchain reports that 47,229 BTC were transferred to anonymous wallets in the last 24 hours. If these BTC are sold, it could introduce about $3.8 billion worth of sell pressure into the market. The movement of such a large quantity of BTC has understandably spooked investors, leading to further declines in Bitcoin’s price.

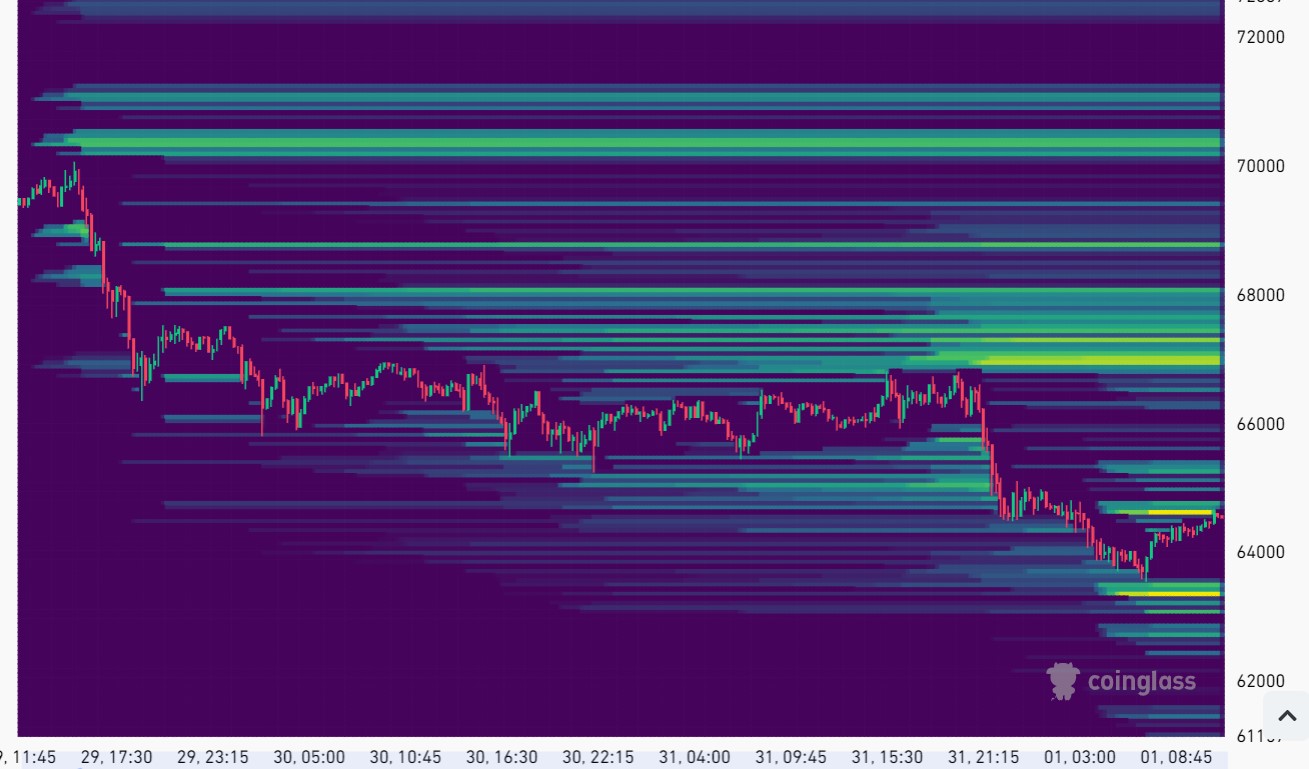

Long Position Liquidations

Long positions in Bitcoin have also played a role in this week’s pullback. Bitcoin liquidity heatmap had two major zones: $68,875 to $68,901, where BTC longs reached $101.8 million, and another between $69,472 and $69,500. The price dip below these levels may have provided more liquidity for short sellers. When Bitcoin’s price fell below these key levels, it triggered stop-loss orders and liquidations of leveraged positions, further exacerbating the sell-off.

Looking Ahead

Will Bitcoin dip further? It’s hard to say, as market dynamics can change quickly. However, the current trend suggests that investors are adopting a wait-and-see approach. Bitcoin reserves concluded July at their lowest levels since 2018, with about 2.6 million BTC remaining on exchanges at press time. This low level of reserves indicates that many BTC holders have moved their assets off exchanges, possibly to long-term storage or to wait for more favorable market conditions.

In conclusion, the combination of profit-taking, economic uncertainty, the impact of Mt. Gox BTC movements, and the liquidation of long positions has created a perfect storm of sell pressure on Bitcoin. While the market remains unpredictable, the current indicators suggest that Bitcoin may experience further volatility in the near term.