Recent data from IntoTheBlock reveals that Polygon (MATIC) has dealt a blow to a significant portion of its holders, wiping out a considerable portion of recent gains and leaving 50% of MATIC holders in the red.

Contrarily, 44% of holders find themselves in profit, with the remaining 6% breaking even. This stark revelation contrasts sharply with the promising performance the token exhibited not long ago.

Just a few weeks prior, many analysts on X highlighted Polygon’s upward trajectory, suggesting a potential surge towards the $2 mark. However, recent days have witnessed a downturn for the cryptocurrency.

At present, CoinMarketCap reports a 4.44% decrease in MATIC’s price over the last week, settling at $0.99. This decline underscores the struggle to breach the psychological barrier of $1.

Nonetheless, this setback doesn’t spell the end for MATIC’s potential. Short-term holders may be banking on a swift recovery.

Polygon’s Path Forward

Amidst the turbulence, Polygon may have a trump card up its sleeve in the form of a significant upgrade – the “Napoli upgrade.” Scheduled for release on March 27th, this upgrade aims to bolster Polygon’s network consensus.

The Napoli upgrade promises enhancements in parallel execution and introduces new operational codes for the Ethereum Virtual Machine (EVM). Notably, it marks the phase-out of Mumbai, the Testnet of the Proof-of-Stake (PoS) network, in favor of the Amoy Testnet.

Such upgrades typically bode well for MATIC’s prospects. With increased buying pressure, there’s potential for MATIC to surge towards $1.30.

Challenges Ahead

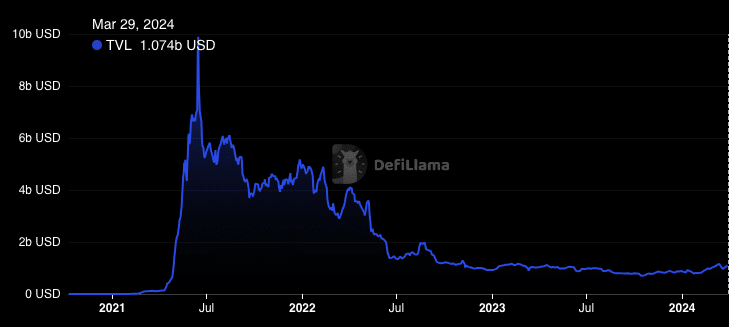

Despite the optimistic outlook, Polygon isn’t without its challenges. Total Value Locked (TVL) on the platform, which once neared $10 billion in 2021, has dwindled to just $1.07 billion, as per DeFiLlama’s latest data.

Source: DeFiLlama

TVL serves as a crucial metric, reflecting the value of assets locked or staked within a protocol. While a surge in TVL indicates market participants’ confidence and liquidity injection, Polygon’s recent figures suggest a struggle to attract substantial liquidity compared to other chains.

However, it’s worth noting that TVL doesn’t always dictate price movements. MATIC’s value could defy network health conditions and witness significant jumps regardless.