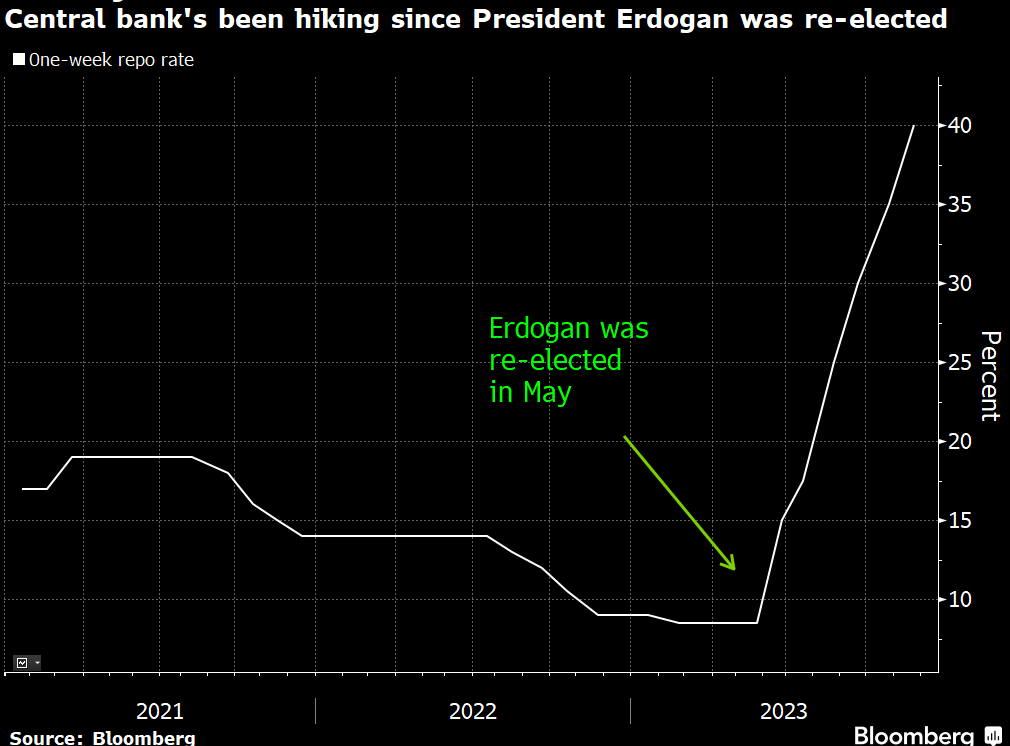

In a bold and unexpected move, Turkey’s central bank recently hiked its key interest rate by a staggering 500 basis points, reaching an unprecedented 40% Bloomberg reports. This decision, double the expectations of economists who foresaw a 250-basis-point hike, underscores the severity of Turkey’s economic challenges, with inflation soaring to a staggering 61% in October.

Cryptocurrency as an Alternative Amid Economic Uncertainty

In the midst of Turkey’s economic struggles, proponents of cryptocurrency find validation in the central bank’s aggressive measures. Cryptocurrencies, decentralized and immune to government manipulation, offer an alternative store of value in times of economic uncertainty.

As the Turkish lira continues to depreciate, many are turning to cryptocurrencies as a hedge against inflation. The central bank’s attempts to stabilize the currency through interest rate hikes may inadvertently drive more individuals toward digital assets, which thrive on principles of decentralization and limited supply.

Challenges and Forecasts

Despite the central bank’s efforts, inflation is expected to remain stubbornly high, with projections indicating a year-end rate of 69.3% and forecasts for 2024 at 43.4%. The Turkish lira’s depreciation and the impact of increased taxes and fees contribute to the ongoing struggle against inflation, leaving citizens grappling with the erosion of their savings.

Cryptocurrency proponents argue that the decentralized nature of digital assets could provide a viable solution to the challenges faced by traditional fiat currencies. Bitcoin, in particular, is often lauded for its capped supply, which prevents central banks from engaging in inflationary practices that erode the value of fiat currencies.

Turkey’s central bank’s bold move to combat inflation through interest rate hikes reflects a departure from past policies, aligning with Austrian economic principles. As the nation grapples with economic challenges, including a weakening currency and soaring inflation, cryptocurrency proponents see an opportunity for digital assets to emerge as a viable alternative. The future of Turkey’s economy remains uncertain, but the intersection of Austrian economic principles and the growing interest in cryptocurrencies may pave the way for innovative solutions amid economic turmoil.