The increase in realized losses on-chain suggests another BTC rally may be imminent. Historical data from the cycle detector indicates that Bitcoin is not in a bear phase.

If the current cycle is still bullish, Bitcoin (BTC) might be near its bottom, as indicated by the Short Term Holder (STH) Spent Output Profit Ratio (SOPR).

What is SOPR?

SOPR stands for Spent Output Profit Ratio, an indicator that provides insights into the realized profits of all coins traded on-chain, focusing specifically on the short term.

How Do Losses Affect Bitcoin’s Price?

When the STH-SOPR is above 1, it indicates that BTC was sold at a profit, meaning the selling price was higher than the purchase price. Conversely, a metric below 1 means BTC was sold at a loss, with the selling price lower than the purchase price. According to CryptoQuant, Bitcoin’s STH-SOPR has recently dropped to 0.98.

Historically, when the STH-SOPR falls below 1, it often implies that Bitcoin has either hit its bottom or is close to it. A similar situation occurred in September 2023 when Bitcoin’s price was $26,253, and the SOPR was in a similar range. By November of the same year, Bitcoin’s price had surged to $35,441.

This pattern has been observed in other bull cycles, such as those in 2021 and 2018. If this trend continues, Bitcoin’s price could potentially increase by 34.99% within two months. Currently, BTC is priced at $57,154, suggesting it could reach around $77,100 by September.

Should this prediction come true, Bitcoin might hit a new all-time high this quarter.

Is the Bull Phase Still Ongoing?

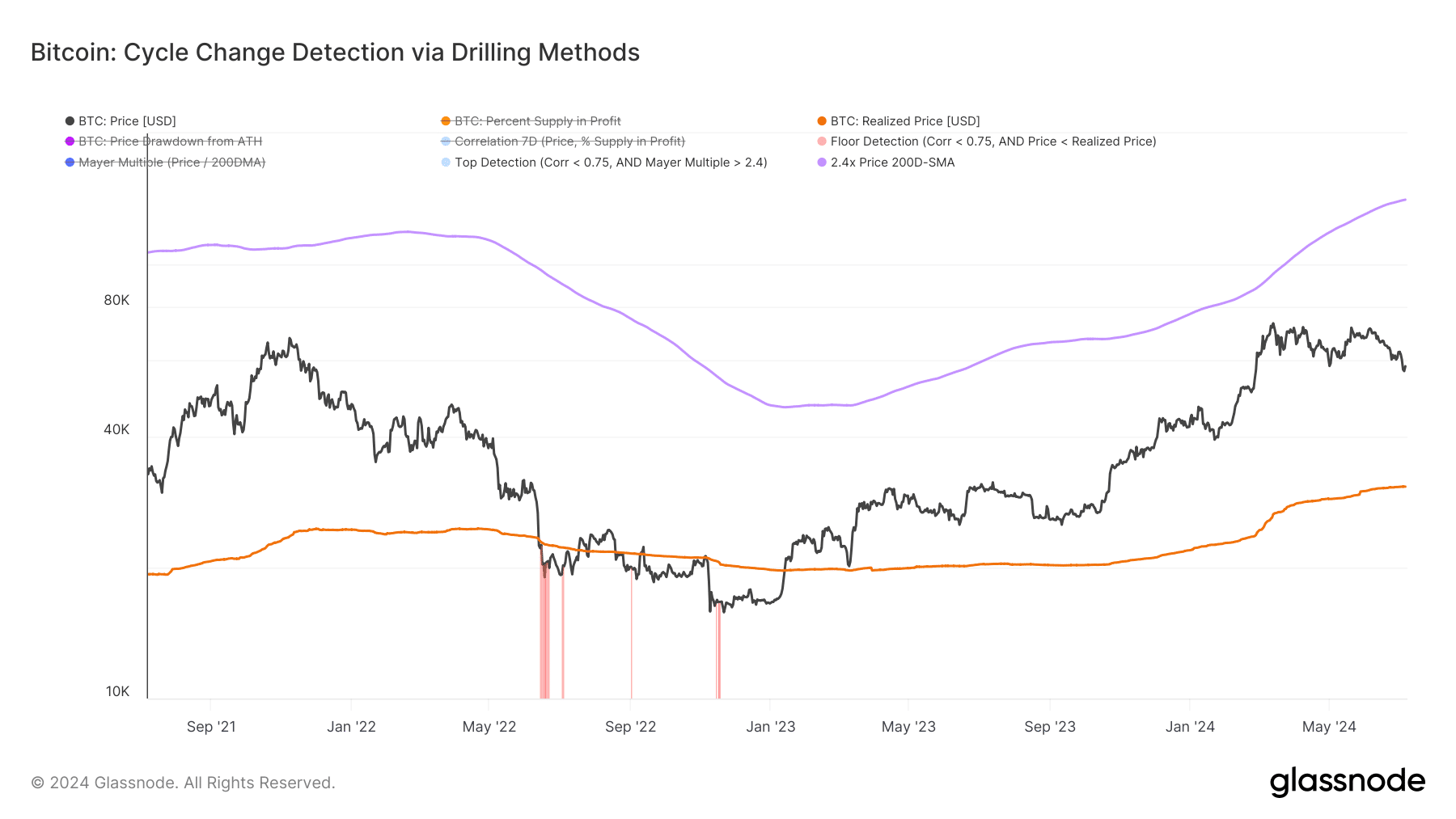

Despite a recent drop to $54,274, which sparked concerns of a bear market, the data doesn’t support this shift. We examined Glassnode’s Bitcoin Cycle Change Detector to get a clearer picture.

This detector identifies transitions between bull and bear markets. A shift to a bear market turns the chart red, as seen in November 2022. As of now, no such transition has occurred.

Unless nearly 100% of circulating Bitcoin is in profit, a bear market transition is unlikely. Given the current data, it appears Bitcoin may have reached its bottom.

Therefore, BTC could reach significantly higher values before the quarter ends, possibly between $76,000 and over $80,000. However, this prediction could be invalidated if significant selling pressure re-enters the market.