The culmination of Bitcoin’s fourth halving event has arrived, sparking discussions and speculations about its impact on the market and the future trajectory of the cryptocurrency. This significant milestone, occurring roughly every four years, has profound implications for Bitcoin’s scarcity, its role as a store of value, and its potential price movements.

On April 20th, in the early hours of GMT time, Bitcoin crossed the threshold of its 4th halving as the 840,000th block was added to its blockchain. This event triggered a reduction in mining rewards from 6.25 BTC to 3.12 BTC, underscoring Bitcoin’s deflationary nature and its journey toward its ultimate supply cap of 21 million coins.

In the lead-up to the halving, the cryptocurrency market experienced heightened volatility, reflecting uncertainty and anticipation surrounding the event. As of the latest data, Bitcoin’s price stands at $64,900, with a slight surge of nearly 2% observed in the past few hours alone. Technical indicators suggest a mix of bearish and bullish signals, with the Moving Average positioned above price candles while the Chaikin Money Flow (CMF) remains in positive territory, indicating capital inflows.

The scarcity narrative surrounding Bitcoin has gained prominence with each halving, aligning with its creator’s vision of a finite digital asset. This diminishing supply, coupled with increasing demand, has positioned Bitcoin as a potential hedge against inflation and a digital equivalent to gold in mainstream finance.

Historically, Bitcoin has experienced significant price rallies following halving events. The 2016 halving preceded a 3x surge in Bitcoin’s value over the subsequent 12 months, while the 2020 halving saw an astonishing 500% increase in the king coin’s price in the following year. These past performances have fueled optimism among market participants regarding the potential for another bullish run post-halving.

The current halving holds particular significance given the prevailing market conditions. Amidst what appears to be a continuing bull market phase, the demand for Bitcoin has surged, fueled in part by the introduction of spot exchange-traded funds (ETFs) in the United States earlier in the year. These investment vehicles have attracted substantial inflows, with over $12.23 billion in cumulative net inflows recorded since their inception. On average, approximately $120 million in Bitcoin flows into these funds daily.

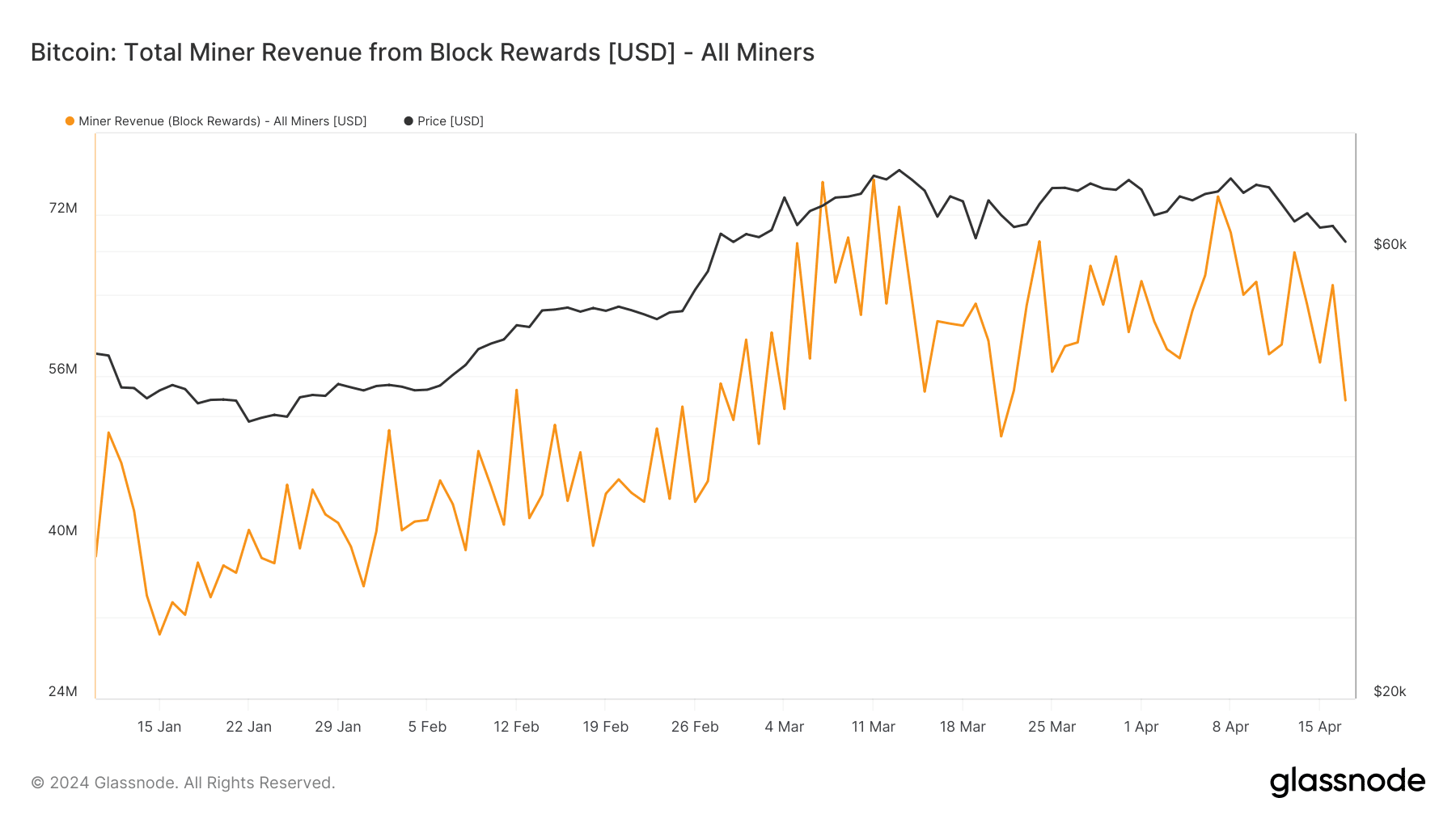

In contrast, the rate of new Bitcoin issuance through mining stands at an average of $50 million per day, according to data from Glassnode. This supply-demand dynamics suggests a significant shortfall in available Bitcoin, with demand outstripping supply by more than double at the time of writing. With the impending further reduction in supply due to the halving, this supply-demand gap is expected to widen further, potentially driving Bitcoin prices higher in the coming months.

As Bitcoin continues its journey through halvings and market cycles, its role as a leading digital asset and store of value is increasingly solidified. The 4th halving marks another step in this evolution, with implications that extend far beyond its immediate price movements. Whether Bitcoin will indeed achieve another 500x price climb remains uncertain, but the underlying fundamentals and market dynamics suggest continued growth and resilience in the face of economic uncertainties.