Bitcoin’s price has been ensconced around the $70,000 mark for weeks, resulting in a period of lateral movement that’s left traders scratching their heads. This lack of definitive movement offers little insight into where BTC might be headed next. However, amidst this uncertainty, there are potential signals indicating a forthcoming shift, including a possible retracement below $60,000, which could serve as a strategic buying opportunity ahead of the fourth halving event.

Stagnant Price Action:

Over the past month, Bitcoin has exhibited a sideways trajectory, failing to break free from its consolidation phase. This scenario bears resemblance to a similar pattern observed between mid-December and mid-January. During that period, Bitcoin underwent a sweep of both range highs and lows, essentially gathering liquidity on both ends before embarking on a decisive upward trajectory.

Current Indicators:

A notable parallel is the occurrence of a sweep of range lows on January 23, propelling Bitcoin’s price into a weekly imbalance zone extending from $38,435 to $39,996. Presently, a comparable imbalance is evident at the bottom, spanning from $53,120 to $59,111. If historical patterns repeat themselves, Bitcoin may dip into this range before clarifying its directional bias.

Influencing Factors:

The upcoming fourth Bitcoin halving event, scheduled for April 19, looms as a significant factor contributing to Bitcoin’s current consolidation phase. Historically, this event has precipitated considerable market movement, often characterized by rallies leading up to the halving followed by corrections shortly thereafter.

Additionally, macroeconomic dynamics play a crucial role in shaping Bitcoin’s price trajectory. With prevailing high interest rates driving capital towards safer assets, cryptocurrencies like Bitcoin and Ethereum, alongside stablecoins, stand to benefit. The rise in Bitcoin dominance reflects this capital rotation trend.

On-chain Metrics:

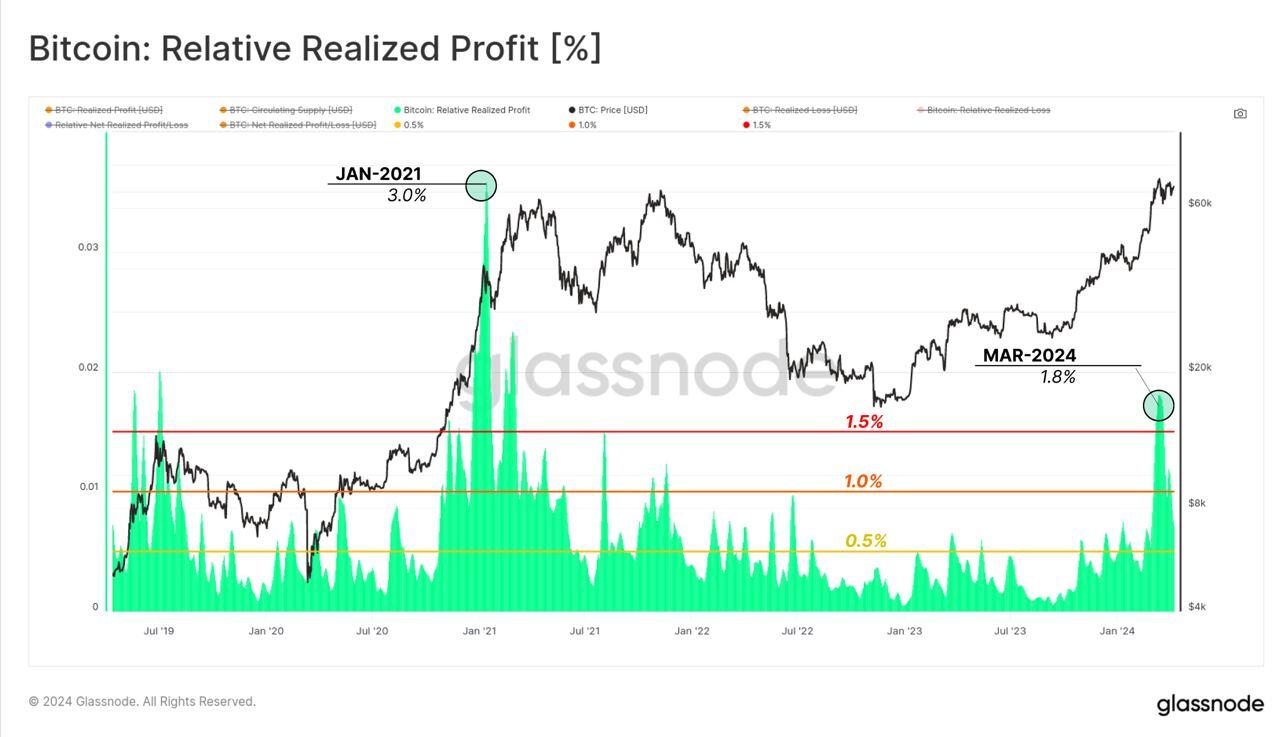

Despite Bitcoin reclaiming its 2021 highs, metrics such as relative realized profit indicate a lower profit-taking intensity compared to previous years. The Short-term Holder (STH) Market Value to Realized Value (MVRV) Momentum Indicator offers insights into the unrealized profit or loss of recent market entrants, potentially indicating moments of capitulation or profit-taking.

Looking Ahead:

Despite short-term uncertainties, the long-term bullish outlook for Bitcoin remains robust, supported by on-chain metrics and macroeconomic trends. However, traders must remain vigilant amidst the current consolidation phase. A breach of the $45,156 level could trigger a significant sell-off, potentially challenging the bullish narrative and leading to further downside.