The cryptocurrency market has achieved a significant milestone, surpassing the $2 trillion mark in total market capitalization, a feat not seen in over two years.

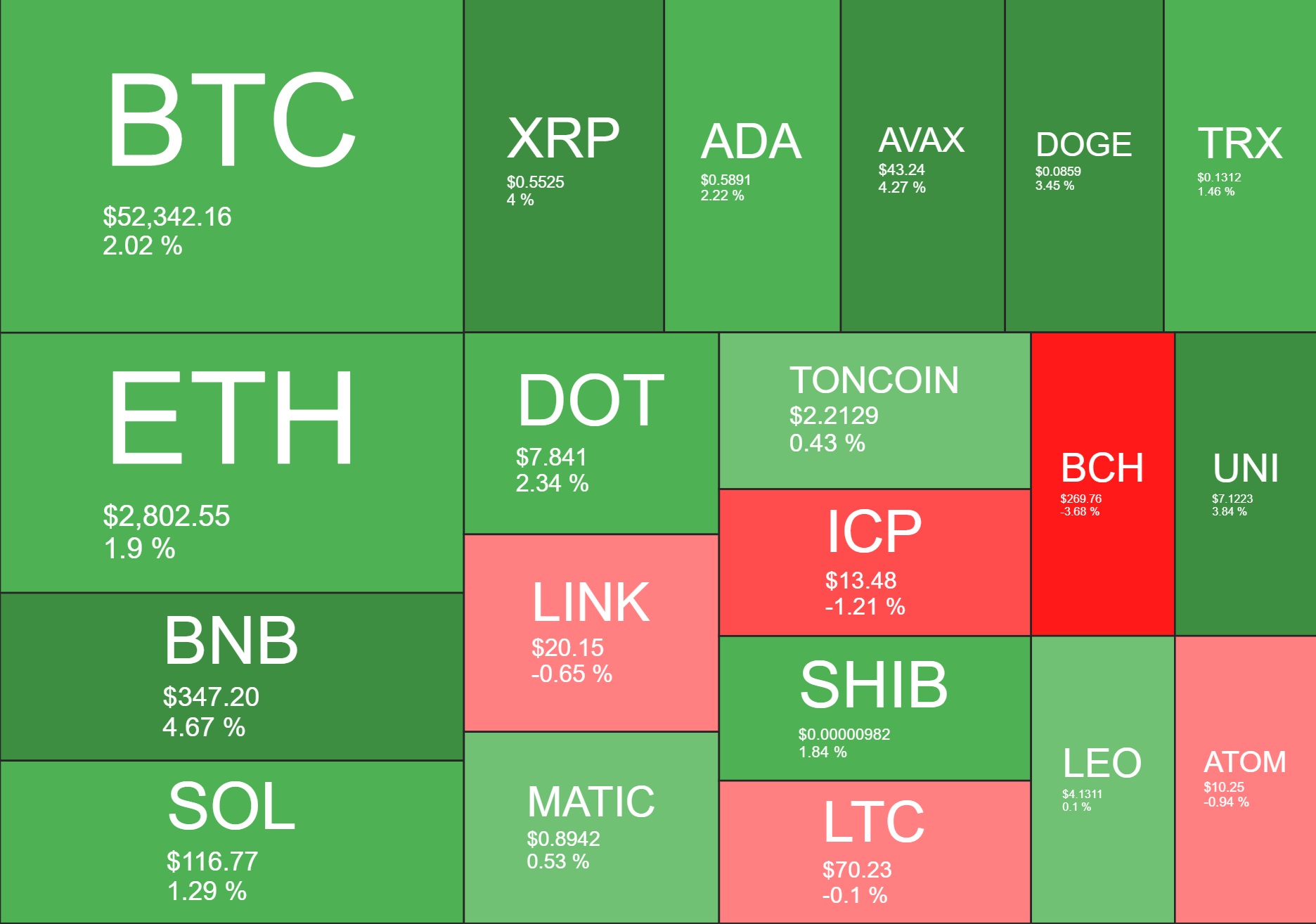

Bitcoin, the pioneer cryptocurrency, has sustained its upward trajectory, breaching the $52,000 threshold within the past 24 hours. Concurrently, various alternative cryptocurrencies, or altcoins, have also demonstrated positive movement, with XRP reaching $0.55 and ADA approaching $0.6.

BTC’s recent performance has been notably robust, culminating in a 13% gain for the week, marking its most substantial weekly increase since October of the previous year. Although Monday saw a minor retracement from $48,800 to $48,000, this setback was short-lived. Subsequently, Bitcoin surged beyond $50,000, marking its first foray into this territory since late 2021. Despite a brief downturn to $48,400 following the release of the latest US Consumer Price Index (CPI) data on Tuesday, BTC quickly regained momentum. Its ascent continued, propelling it past $52,000 earlier today, establishing a new multi-year peak.

Reclaiming the $1 trillion market cap milestone, Bitcoin’s market capitalization surged to $1.025 trillion, with its dominance exceeding 54%.

Meanwhile, Ethereum has also showcased notable resilience, with a 2% increase in the past 24 hours propelling the second-largest cryptocurrency to $2,800, a level not seen since May 2022.

Other major altcoins, including Binance Coin, Ripple, Cardano, Avalanche, and Dogecoin, have witnessed even more significant daily gains, ranging from 3% to 4%. However, Bitcoin Cash and ICP have experienced retracements among the larger-cap altcoins.

Additionally, smaller and mid-cap altcoins have also experienced notable gains over consecutive days, contributing to the collective market cap reclaiming the $2 trillion threshold on CoinGecko, and nearing that milestone on CoinMarketCap. Notably, tokens such as APT and IMX have seen increases of around 5%.

Overall, the recent performance of the cryptocurrency market underscores its resilience and ongoing bullish sentiment, as evidenced by the sustained upward trajectory of leading cryptocurrencies and the broader market.