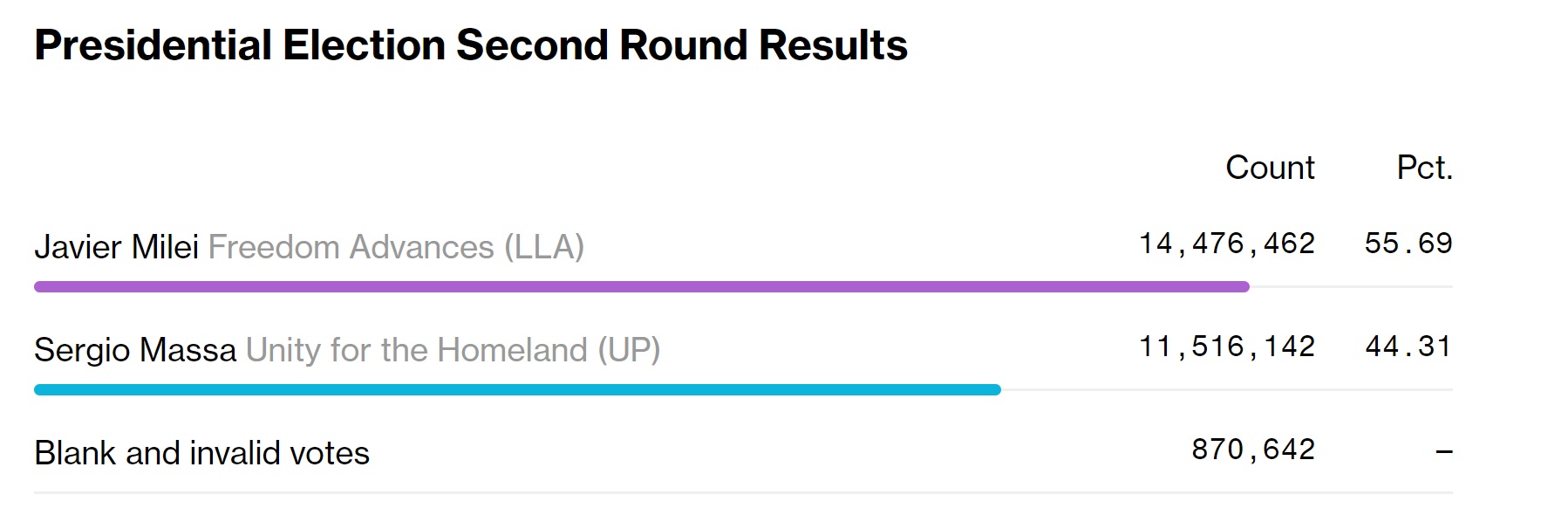

In a resounding victory, Javier Milei emerged triumphant in Argentina’s presidential election, garnering over 2 million votes more than his opponent, Sergio Massa. The nation eagerly anticipates the positive changes that Milei, a proponent of Bitcoin, will bring as he assumes office on December 10.

Late on a Sunday night, according to Bloomberg, the official confirmation of Milei’s victory marked a turning point for Argentina. While he has not explicitly called for Bitcoin to become legal tender or a reserve asset, Milei has put forth plans to replace the struggling Argentine peso with the more stable US dollar. The urgency for change became evident as the Argentine peso experienced hyperinflation, soaring to a staggering 143% just the previous Monday, leaving the country in dire financial straits.

Earlier this year, the citizens of Argentina passionately rallied in support of Bitcoin, forming a massive BTC symbol to voice their discontent with the rampant inflation plaguing their nation.

Second Bitcoin President.

Congratulations to @JMilei on his landslide victory in Argentina. pic.twitter.com/CNOqFbb5Q8

— Balaji (@balajis) November 20, 2023

A vocal critic of central banking, Milei has not minced words in expressing his disdain for what he sees as a deceptive mechanism. He boldly declared, “The central bank is a scam, a mechanism by which politicians cheat the good people with inflationary tax.” His views on Bitcoin are equally affirmative, describing it as “the return of money to its original creator, the private sector,” and highlighting its role in preventing politicians from exploiting the public through inflation.

In a symbolic act, Milei once appeared on a TV show, vigorously beating a piñata shaped like a central bank with a stick, underscoring his commitment to challenging traditional financial systems.

While the future of Bitcoin in Argentina may seem uncertain, Milei’s inauguration is viewed optimistically as a potential precursor to the country following in the footsteps of El Salvador, officially adopting Bitcoin as legal tender and incorporating it into its reserve assets. The prospect of a Bitcoin-friendly leader in Argentina offers hope for a brighter and more innovative financial future for the nation.

Immediately after the election results, the Bitcoin price surged by more than $1000 hitting $37,500. Was this as a result of the elections in Argentina? Feel free to discuss that in the comments below.