Bitcoin’s transaction fees have surpassed those of Ethereum for the first time in years, marking a significant shift in the ongoing competition between the two cryptocurrencies. Historically, Ethereum’s block producers had consistently outpaced Bitcoin miners in collecting transaction fees, owing to Ethereum’s broader range of applications beyond simple transactions.

However, recent data from Blockchain.com reveals that in the last seven days, Bitcoin transaction fees have exceeded Ethereum’s. This comes as a notable departure from the trend observed since around 2020, where Ethereum consistently outperformed Bitcoin in fee collection.

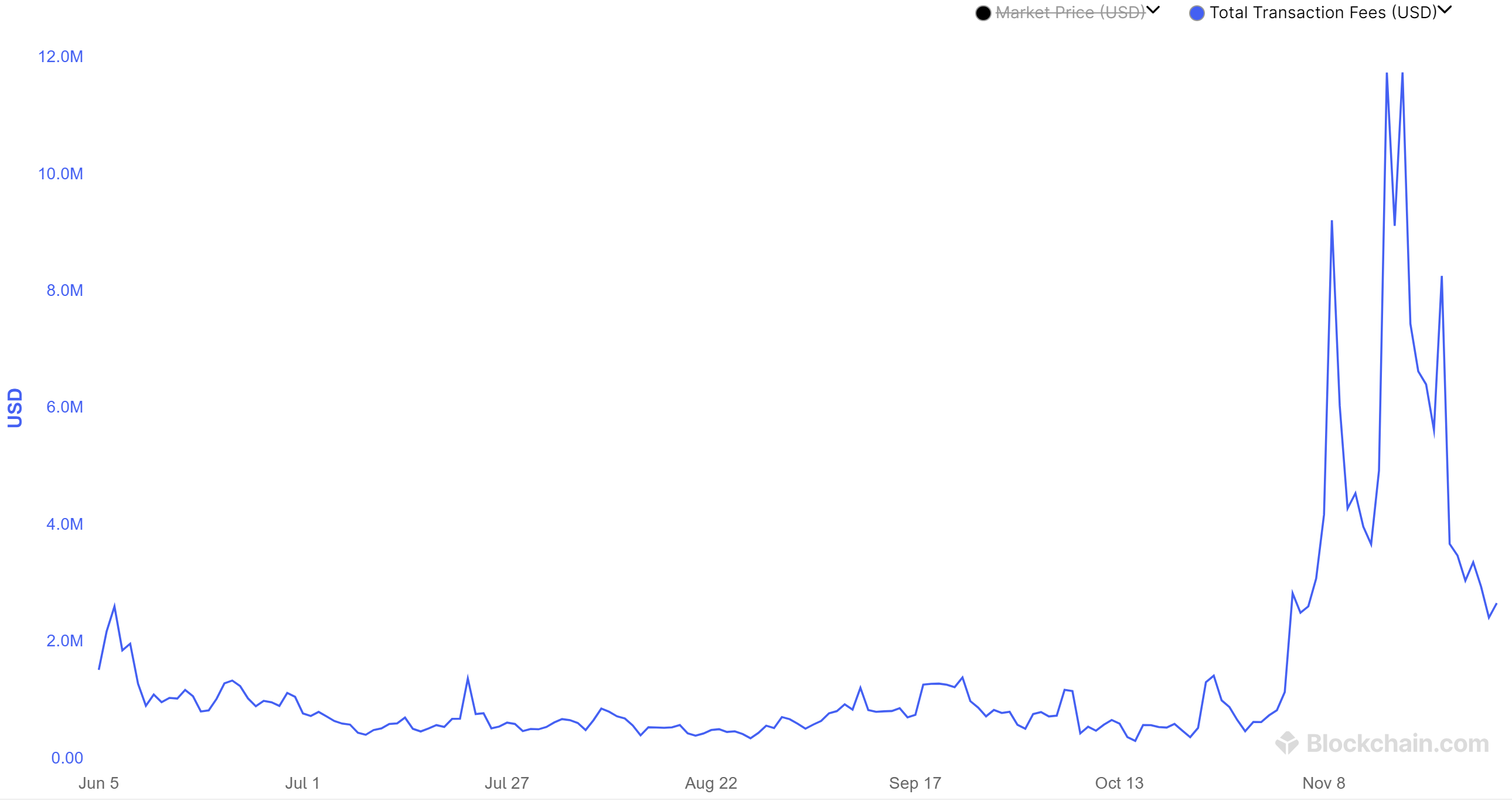

Source: Blockchain.com

Throughout November, Bitcoin’s transaction fees have seen a substantial increase, with miners accumulating between two and twelve million dollars in fees daily. This surge contrasts sharply with the previous months, where fees ranged from 300,000 to 1.2 million dollars. The growth in Bitcoin transactions is remarkable, with fee income rising from 16-50 Bitcoin between July and November to 30-317 Bitcoin.

The upcoming fourth halving, expected to reduce the reward to 3,125 Bitcoins, poses a challenge to miners. However, the record-setting days in November contribute significantly to mitigating potential security losses during the halving.

For Bitcoin users, the noticeable increase in transaction fees poses challenges. While fees were around two dollars in the fall, they have now exceeded five dollars on most days in November, reaching over 20 dollars on peak days. This development benefits miners and network security but presents a less favorable scenario for regular users.

In contrast, Ethereum’s fee landscape has evolved differently. Following a substantial spike in fees from 2020 to spring 2022, Ethereum fees have steadily decreased to a minimum of 300, a maximum of 1000, and typically 500-600 Ether in November. This translates to $1-1.2 million on normal days.

The November anomaly, where Bitcoin surpassed Ethereum in fee income, is notable. Ethereum’s activity has expanded into various Layer 2s over the years, with only 15-30 percent of daily transactions occurring on the main chain.

The surge in Bitcoin fees can be attributed to the Ordinals protocol, which facilitates the inclusion of NFTs and fungible tokens on the blockchain. Despite the initial hype calming in early summer, Ordinals fees skyrocketed in November, contributing more than 20 Bitcoin in fees on most days and even reaching 122 to 133 on outliers.

The Ordinals’ strong demand has become a key driver of Bitcoin fees, with notable increases observed on November 16th and 18th. The reasons behind the Ordinals resurgence are not entirely clear, but the dominance of “text” ordinals and the explosion of fees generated by BRC-20 tokens suggest a built-up ecosystem around these tokens, influencing miners to charge high fees and driving up transaction costs for all users.