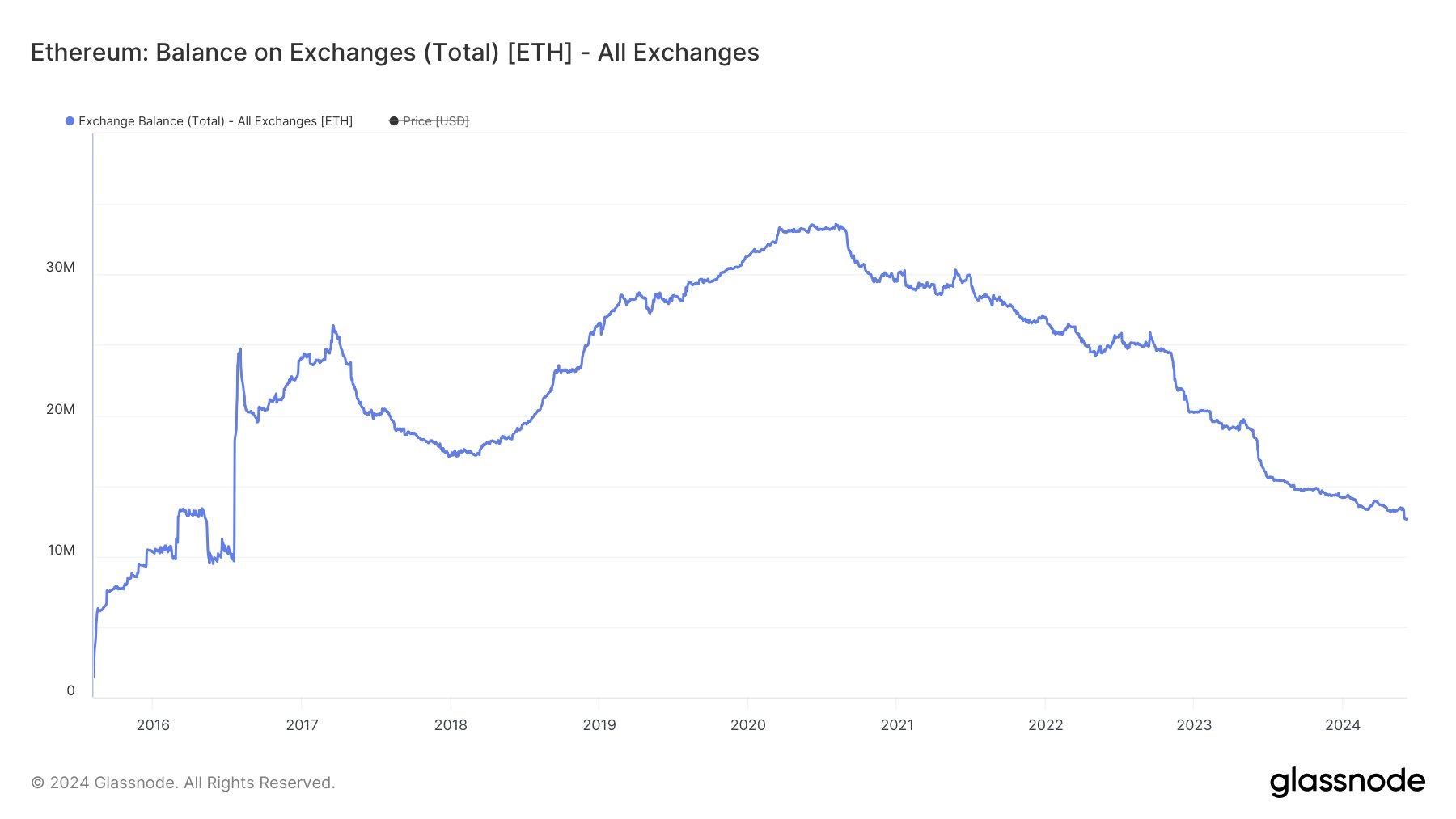

Ethereum reserves on exchanges have plummeted to their lowest levels in eight years, potentially setting the stage for a significant price increase. Despite current bearish signals suggesting further declines are possible before a rebound, this scarcity of Ethereum (ETH) on exchanges could lead to dramatic price movements, especially with the launch of spot ETFs on the horizon.

Source: Glassnode

Ethereum ETFs to Stir the Market?

The anticipated launch of spot ETFs could trigger substantial interest in Ethereum. If these ETFs attract significant investment, an initial surge in buying could drive prices up swiftly. This rush might be followed by market corrections as supply and demand dynamics stabilize.

Current Market Indicators

Ethereum’s price is currently below both the 50-period and 200-period moving averages, indicating a bearish trend. The Relative Strength Index (RSI) stands around 43, below the neutral 50 mark but not yet in oversold territory (below 30). This suggests there might be further room for price declines before reaching conditions that typically precede a rebound.

Holder and Transaction Insights

A substantial 89% of Ethereum holders are currently in profit, signaling a healthy market. Moreover, 51% of Ethereum is held by whales, indicating significant concentration in a relatively small number of wallets. Over the past week, transactions exceeding $100K totaled $32.81 billion, highlighting robust activity from institutional or large-scale investors. This points to a bullish sentiment among significant market players.

Market Valuation and Future Outlook

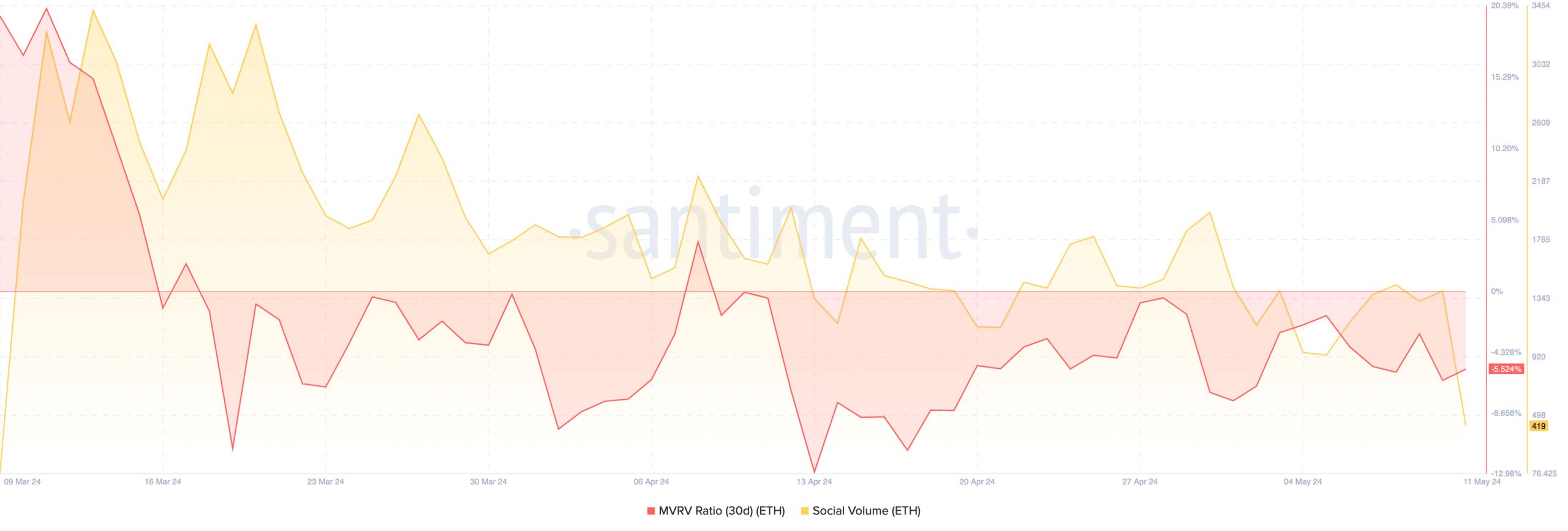

Recent downward trends in the Market Value to Realized Value (MVRV) ratio suggest Ethereum might be moving towards a less overvalued or even undervalued state, providing a more stable foundation for future price increases. This cooling-off period could be a healthy market correction, setting the stage for a more sustainable bull run.

Source: Santiment

If Ethereum can maintain support above $3,670, it may attempt to break the resistance at $3,733. Successfully surpassing this level could propel the price towards the next psychological barrier at $3,800.