Ethereum (ETH) generated significant buzz in the crypto space following the U.S. Securities and Exchange Commission’s approval of ETH ETFs. Although ETH’s price didn’t immediately surge, the landscape could change in the coming days.

Is Buying Pressure High?

Prior to the ETF approval, there was substantial anticipation and hype, leading to volatile, upward price movements for ETH. However, post-approval, Ethereum’s price momentum cooled down. Over the past week, ETH has struggled, with CoinMarketCap data showing a decline of over 2%. At the time of writing, Ethereum was trading at $3,814.82, with a market capitalization exceeding $458 billion.

In an interesting development, popular crypto analyst Ali recently tweeted about a notable shift. According to his tweet, approximately 777,000 ETH, valued at around $3 billion, have been withdrawn from crypto exchanges since the ETF approval. This suggests high buying pressure, which could positively impact ETH’s price.

Since the @SECGov approved spot #Ethereum ETFs, approximately 777,000 $ETH — valued at about $3 billion — have been withdrawn from #crypto exchanges! pic.twitter.com/EzQVC0cw27

— Ali (@ali_charts) June 2, 2024

To verify this, we analyzed on-chain metrics. Data from Santiment showed that Ethereum’s exchange outflow decreased last week, while its supply on exchanges increased, indicating that investors were selling rather than buying ETH. Additionally, the supply of ETH held by top addresses also dropped slightly, suggesting that whales were selling as well.

Looking Forward

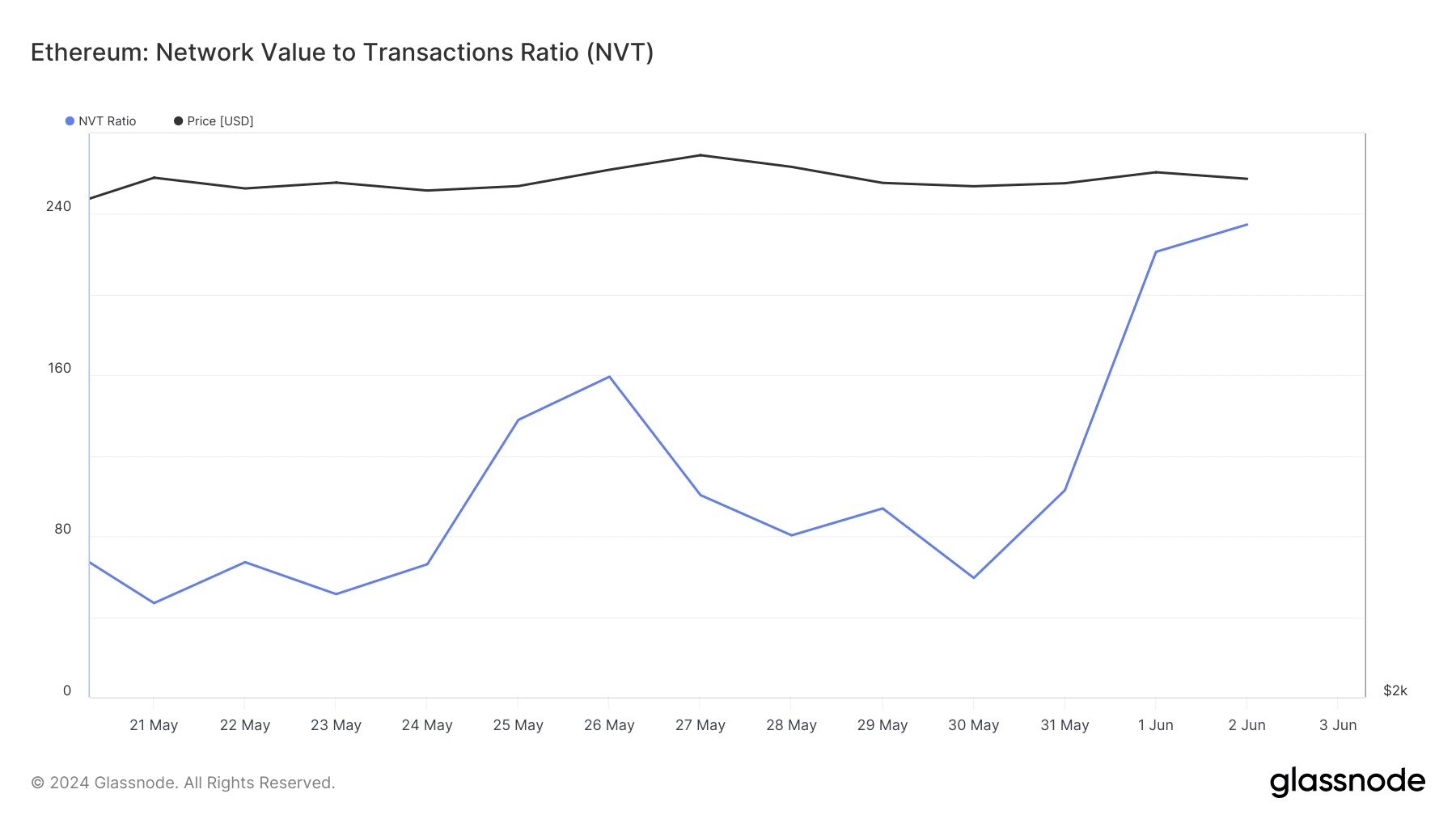

As selling pressure increased, a crucial metric turned bearish. Analysis of Glassnode data revealed a sharp uptick in Ethereum’s NVT ratio on June 1st. The NVT ratio, calculated by dividing market cap by on-chain volume in USD, indicates that an asset may be overvalued when it rises. This suggests a high probability of a price correction.

Further analysis of Ethereum’s daily chart showed a bearish crossover in the MACD technical indicator, hinting at a potential price correction.